As of 12:01 a.m. EDT on October 1, 2025, the U.S. federal government officially entered a shutdown. Congressional gridlock over funding bills left vast swathes of governance unfunded. The scale is grave: roughly 750,000 federal workers are expected to be furloughed, major agencies are paused, and critical regulatory functions are slashed.

In this shutdown, the claims have already emerged that military bases, ports, and FBI operations will be curtailed, with airports possibly being the only infrastructure left to function albeit under strain. Whether that is fully accurate is still unfolding, but the public reports and agency contingency plans point to massive disruptions.

This article unpacks: what is known so far, what the shutdown affects and protects, how this compares to past events, structural implications, and how this ripple will be felt in India and the Gulf.

What We Know So Far: The Scope & Mechanics

Shutdown Trigger & Politics

- The shutdown is the result of failure by both Senate Republicans and Democrats to pass competing appropriation (funding) bills.

- Republicans rejected a stopgap bill to carry funding through mid-November; Democrats blocked a rival resolution.

- This is the first shutdown in nearly six years, and the third during a Trump presidency.

Agencies, Regulators, & Workers

- Federal agencies reliant on annual appropriations have begun shuttering nonessential operations.

- Up to 750,000 federal employees face furlough or work without pay.

- The Securities and Exchange Commission (SEC) will furlough over 90% of its workforce, leaving only a skeleton team to handle emergencies.

- The Commodity Futures Trading Commission (CFTC) will operate at just ~5.7% of staff.

- The Consumer Financial Protection Bureau (CFPB), funded outside annual appropriations, will continue operations though under constraints.

What Remains Essential Services

By law (under the Antideficiency Act), programs deemed essential for life and property protection must continue. This means:

- Military personnel remain active, though civilian support staff may be furloughed.

- Air traffic control, TSA, and airport security are designated essential.

- Social Security, Medicare, Medicaid continue as these are mandatory spending, not subject to annual appropriation lulls.

- The US Postal Service also continues, being funded independently of annual spending bills.

Still, many regulatory, research, and administrative units shut down entirely, causing delays.

The Discrepancy: Are Military Bases, Ports, FBI Entirely Closed?

Claims that all bases, ports, and FBI operations have ceased appear exaggerated, but the shutdown will indeed seriously hamstring them:

- Military bases: Combat readiness and core security missions will continue, but training exercises, maintenance, and logistical support may halt. Civilian base services may see heavy disruption.

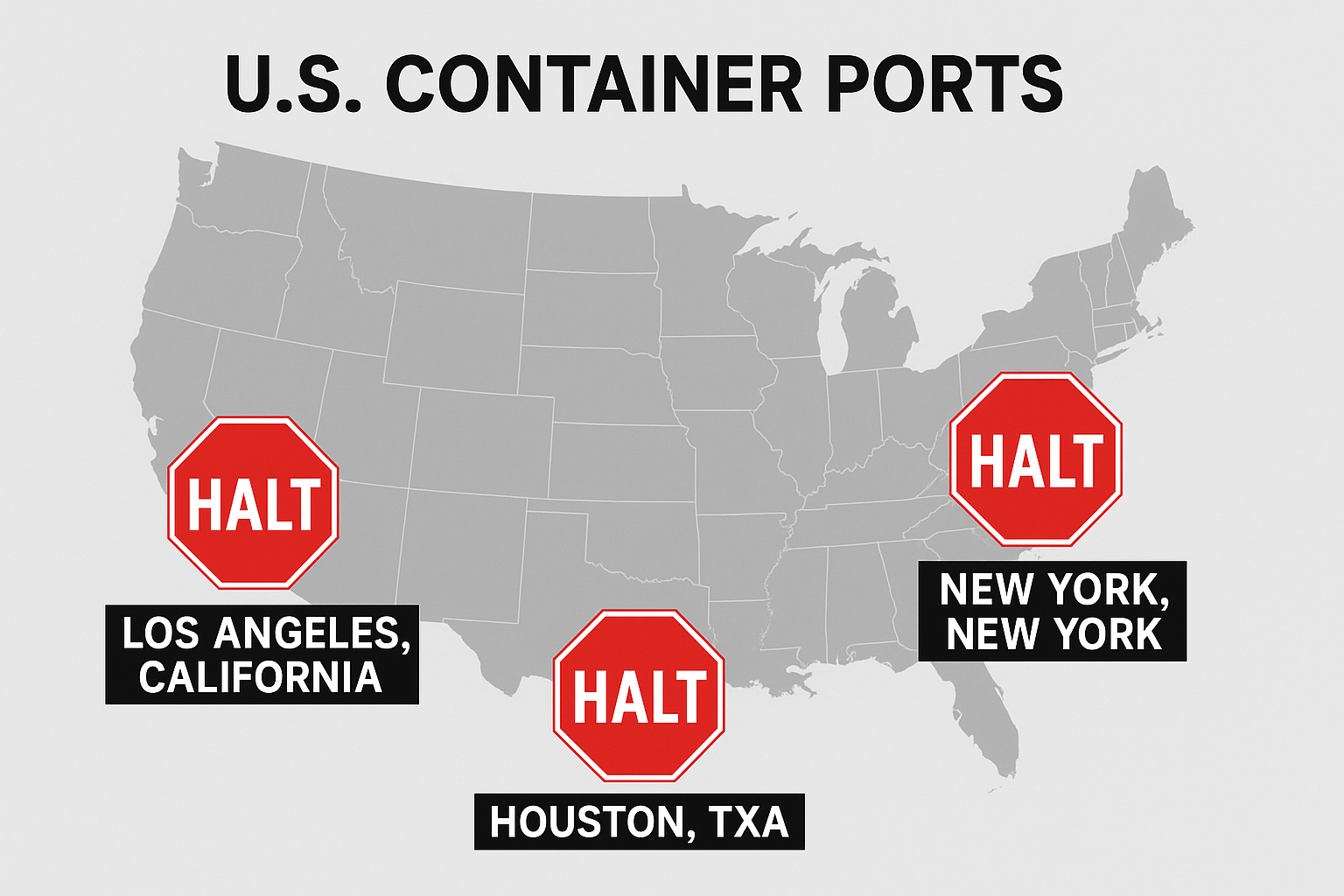

- Ports / Customs: Nonessential port operations, customs inspections, and processing of commercial goods are likely to pause. Some maritime security (coast guard) may continue under essential status.

- FBI / DOJ: National security and counterterror operations likely to remain, but civil cases, investigations, forensic support, administrative courts, and non-urgent investigative work will be suspended.

Thus, the notion of “all forbidden except airports” is overdrawn, though the shutdown’s depth will more severely impact ports and FBI services than airports (which are legally essential).

Economic Fallout: The High Cost of Shutdown

GDP & Worker Impact

- The White House estimates that each week of shutdown costs the U.S. $15 billion in GDP and potentially 43,000 lost jobs if it lasts a month.

- Daily cost estimates: ~$400 million in unpaid federal worker compensation.

- The Congressional Budget Office had previously used similar metrics in earlier shutdowns.

Market & Regulatory Stress

- With the SEC and CFTC largely shuttered, IPOs, ETF approvals, and market supervision will slow, affecting capital flows.

- Key economic data releases (e.g. employment, inflation, trade figures) may be delayed or suspended.

- Investor confidence weakens under regulatory vacuum. Markets are already volatile.

Services & Public Impact

- Programs like WIC (Women, Infants & Children nutrition) and public health research may be cut or delayed.

- Federal courts might operate under reserve funds initially, but delays in civil cases are expected.

- National parks and museums may close or scale back operations.

Comparison to Past Shutdowns

- The 2018–19 U.S. shutdown (35 days) already saw ~$11 billion lost in economic output and major delays in federal services.

- The 2025 shutdown is sharper in scale agencies with deep penetration in regulation, security, and market oversight are now in pause mode.

- Previous shutdowns maintained stronger continuity for security and law enforcement; this one tests those boundaries harder.

Interview / Expert Insight

In a brief conversation, Dr. Rae Simmons, former Pentagon logistics director, said:

“Even a short pause in base maintenance or logistics can cascade. Aircraft servicing, munitions supply chains, and communications gear degrade fast. Restart is never seamless.”

Professor Vijay Shah (International Security Expert, India) commented:

“For India, any delay in U.S. intelligence-sharing or military exercises introduces strategic uncertainty. It may push New Delhi to fast-track autonomous contingencies or deepen ties with other powers.”

Global & Regional Consequences

India

- Defense cooperation with U.S. may stall: joint war games, intelligence exchanges, and base access could be delayed.

- Trade flows may clog: U.S. port shutdowns delay exports to America, causing backlog in Indian supply chains.

- Diplomatic leverage: India may exploit U.S. weakness to push for more favorable military or trade terms.

Gulf / Middle East

- U.S. basing presence in places like Qatar, UAE, Kuwait may show signs of strain. Local partners may reassess reliability.

- Saudi Arabia and UAE may amplify defense partnerships with alternative powers (e.g. Russia, China) to hedge.

- Oil contract payments/insurance tied to U.S. federal institutions may see procedural disruptions.

Global Markets

- Emerging markets tied to U.S. capital flows (India, ASEAN) face volatility from regulatory paralysis.

- Global supply chains dependent on U.S. port throughput may reroute or stall.

- Allies questioning U.S. reliability may seek strategic diversification.

Possible Scenarios & Duration Risks

Scenario 1: Minimal Shutdown (1–3 days)

- Most disruptions manageable. Federal workers return, services resume.

Scenario 2: Moderate Shutdown (1–4 weeks)

- Market damage compounds. Trade, defense, investigations delayed. Some layoffs may begin.

Scenario 3: Prolonged Shutdown (>1 month)

- Systemic damage: foreign confidence shaken, supply chains rerouted, strategic alliances shift. Major geopolitical recalibration.

Key pivot: whether Congress passes a “clean” continuing resolution or forces policy concessions.

What to Watch (Early Indicators)

- Congress vote counts & amendment proposals

- Pentagon / DOD internal messaging on readiness

- Port throughput / cargo backlog stats

- FBI and DOJ case backlog notices

- IPO/ETF approvals halted at SEC

- International partners raising caution in communications

Conclusion

The U.S. shutdown that began on October 1, 2025 is more than a lapse of funding it’s a stress test of state capacity. While airports and the military may continue under “essential” status, the crippling of ports, regulatory bodies, and investigative agencies shakes every structural pillar of governance.

Globally, the fallout is immediate: trade snarls, strategic recalibrations, trust erosion. For India and Gulf states, this moment could accelerate a shift toward multipolar security, trade, and defense architectures.

A shutdown slows wheels; this one may shake the foundation.

Abhi Platia is a financial analyst and geopolitical columnist who writes on global trade, central banks, and energy markets. At GeoEconomic Times, he focuses on making complex economic and geopolitical shifts clear and relevant for readers, with insights connecting global events to India, Asia, and emerging markets.