Ankara, October 2025 In a bold statement of strategic autonomy, Turkey has announced that it will continue purchasing Russian oil, even as the United States and European Union intensify pressure on countries that maintain energy ties with Moscow.

This policy echoes India’s approach prioritizing national interests over geopolitical alignments and signals a deeper shift in global energy and diplomatic patterns across Eurasia.

The decision underscores how nations from the Global South are asserting their economic sovereignty amid competing Western and Eastern blocs, effectively reshaping post-Ukraine war geopolitics.

Turkey’s Calculated Defiance

Turkish Energy Minister Alparslan Bayraktar reaffirmed Ankara’s stance last week, stating,

“Turkey will not jeopardize its energy security. We will continue to buy oil and gas from Russia on terms that benefit our economy and our people.”

That declaration, though measured, reverberated across Washington and Brussels. Turkey a NATO member is now openly aligning its energy strategy with the pragmatic non-aligned approach pioneered by India, a major buyer of discounted Russian crude since 2022.

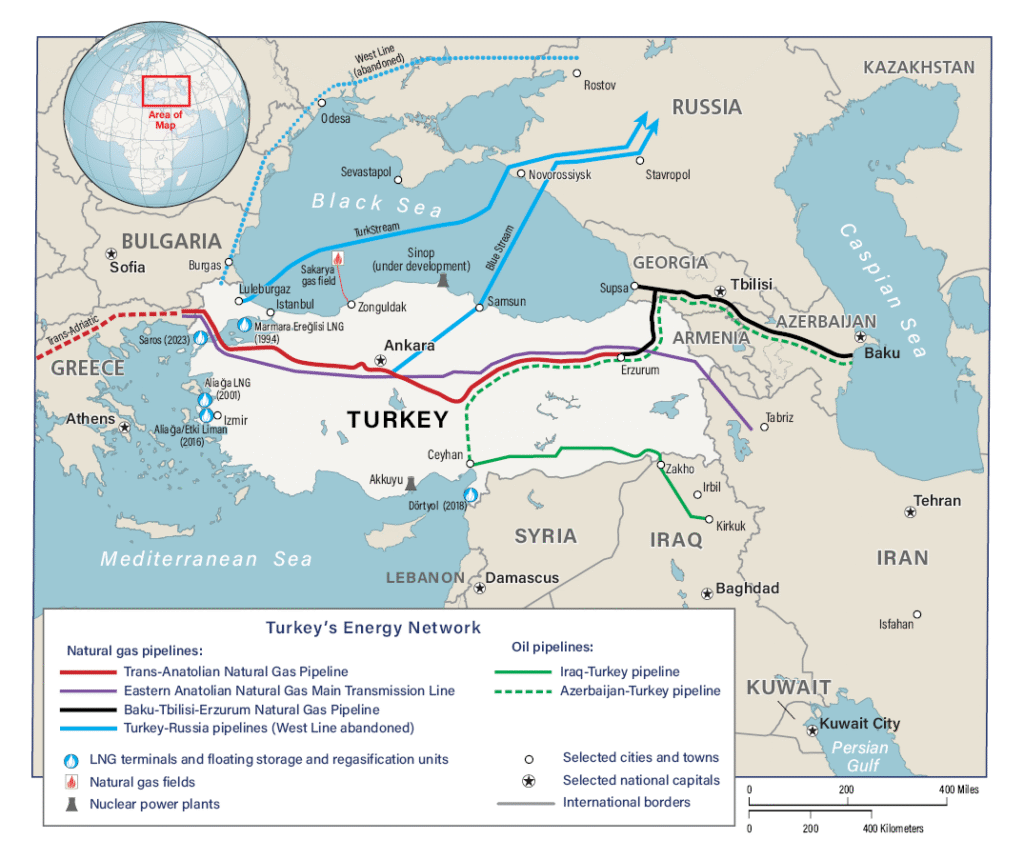

Turkey imports nearly 40% of its natural gas and 20% of its crude oil from Russia. With global energy prices remaining volatile, Ankara argues that cutting off Moscow would devastate its economy, already burdened by inflation exceeding 45% year-on-year and a weakening lira.

For President Recep Tayyip Erdoğan, maintaining affordable energy imports isn’t just about economics it’s about political survival.

Learning from India: Strategic Autonomy in Action

When Western sanctions against Moscow began in 2022, India faced a similar dilemma. Yet, New Delhi charted an independent course increasing Russian crude imports from less than 2% to over 35% of its oil mix within a year. India refined much of this oil domestically and re-exported petroleum products to Europe, turning sanctions into opportunity.

Turkey appears poised to follow a comparable trajectory leveraging its refining capacity at Tupras (Turkey’s state oil refiner) and strategic location between East and West to become an energy corridor rather than a casualty of global divisions.

Ankara’s officials reportedly studied India’s sanction navigation tactics closely including how Indian refiners used rupee-ruble trade mechanisms and third-party intermediaries to maintain compliance while optimizing profits. Turkish banks are now exploring similar dual payment systems, possibly through the Chinese yuan or local currencies.

The Emerging Eurasian Energy Order

This alignment is part of a broader pattern: the rise of a multipolar energy system no longer dominated solely by Western-led institutions.

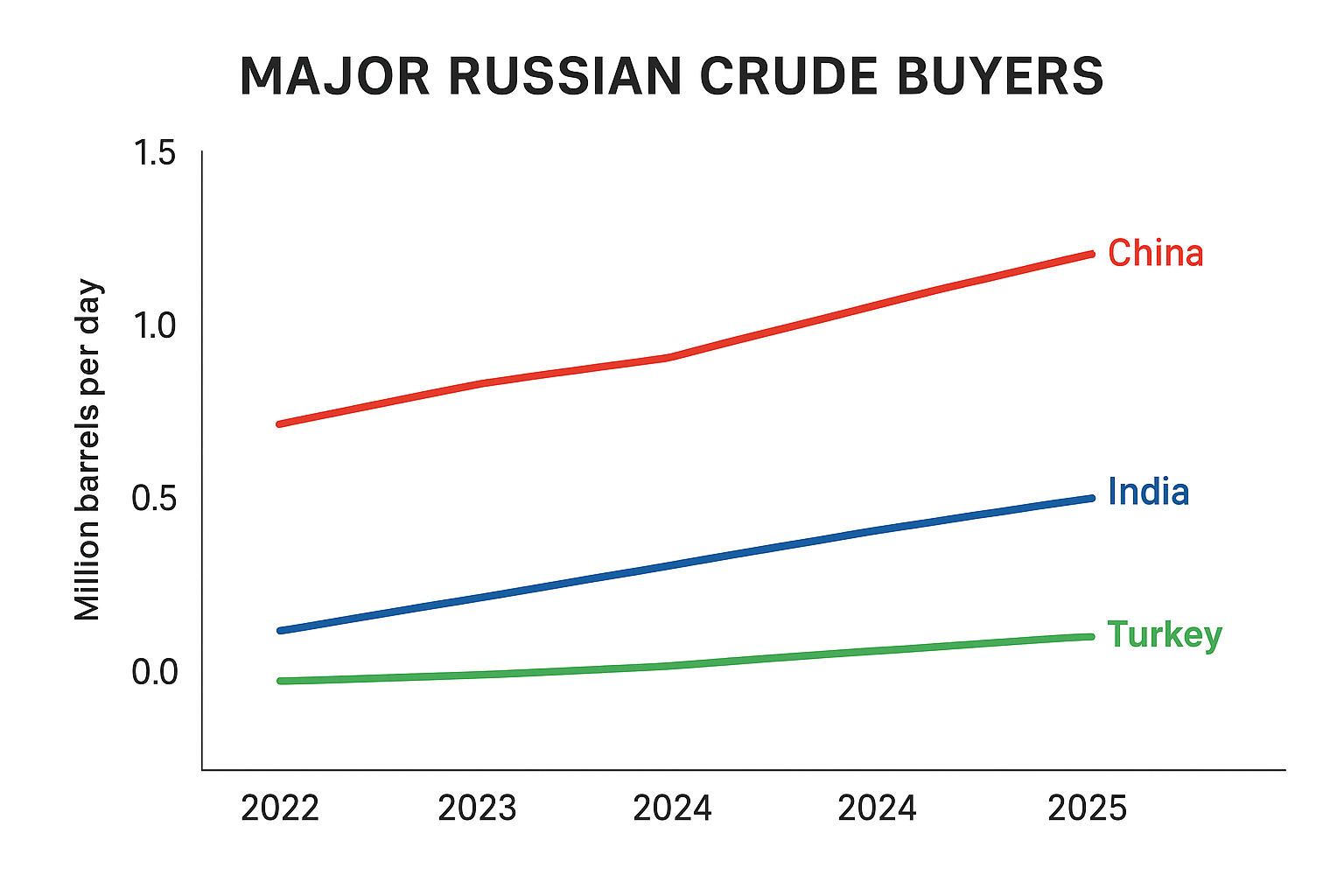

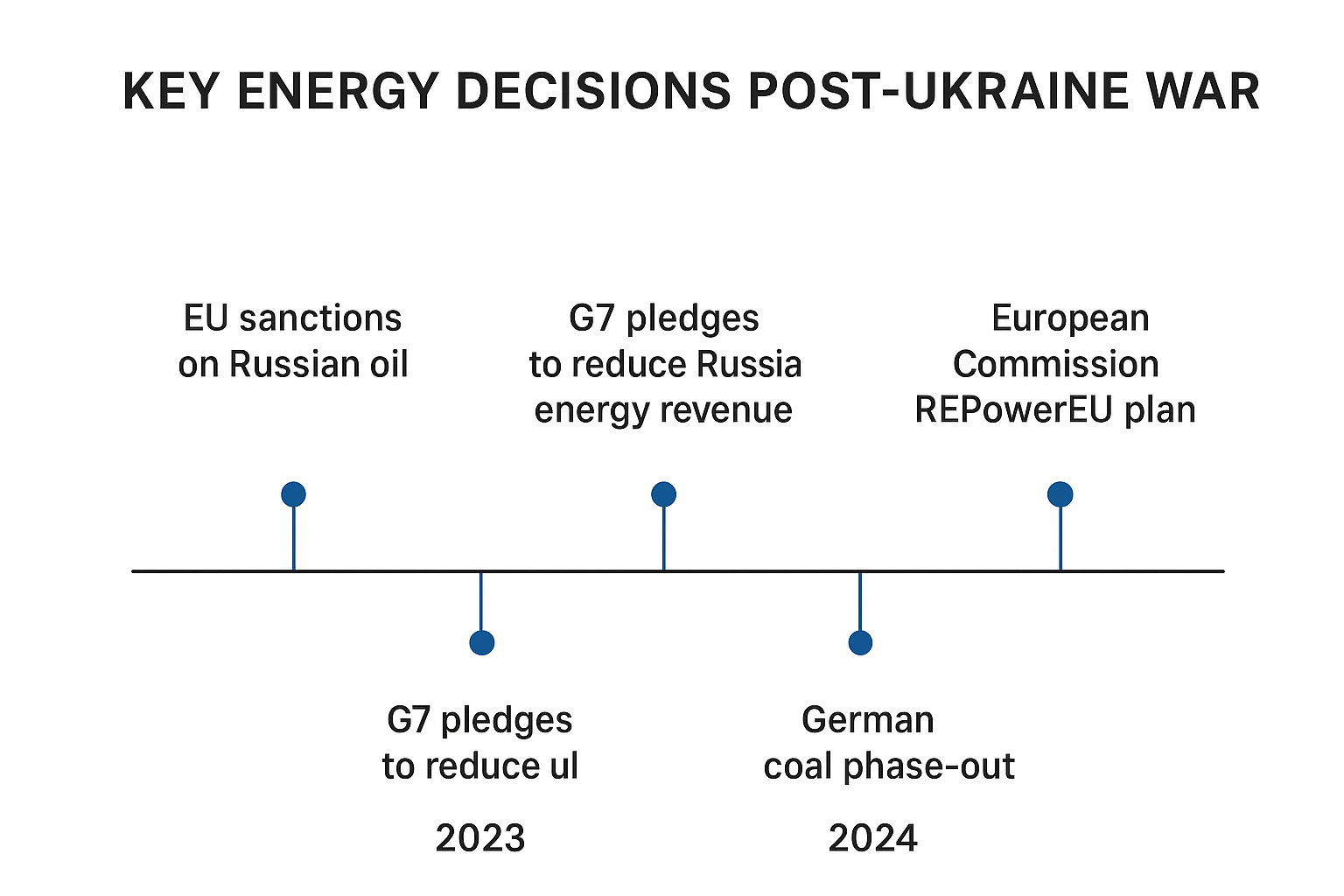

Since 2022:

- India, China, and Turkey have become Russia’s top three crude buyers.

- The Middle East especially Saudi Arabia and the UAE has deepened energy and investment cooperation with Moscow through the BRICS+ framework.

- Russia’s seaborne exports to “friendly nations” have stabilized around 6–7 million barrels per day, offsetting Western bans.

Analysts call this the “Eurasian Energy Axis” a web of mutually beneficial arrangements where countries prioritize affordability, logistics, and sovereignty over Western-imposed norms.

“We’re witnessing the de-Westernization of the global energy market,” argues Dr. Marina Tsvetkova of the Energy Policy Research Centre (EPRC) in London. “Turkey’s stance confirms what India started the idea that energy security is national, not ideological.”

Economic Imperatives Behind the Move

Turkey’s economy is under strain. The lira has lost nearly 30% of its value this year, inflation is biting into household budgets, and foreign reserves remain precarious.

In this context, cheap Russian crude is not just attractive it’s essential.

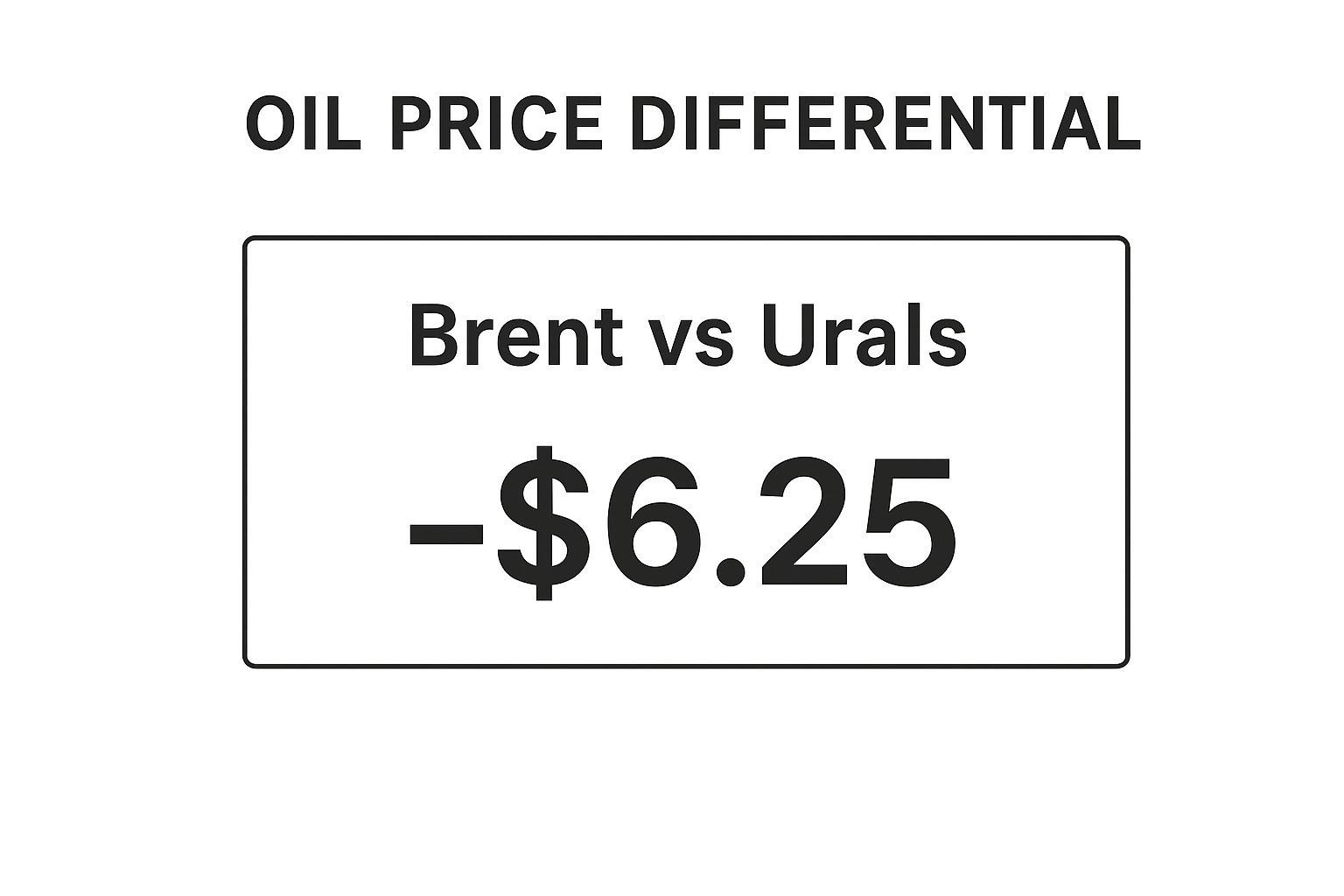

By buying discounted Urals crude, Turkey saves $8–12 per barrel compared to Brent benchmarks. These savings translate into hundreds of millions in annual fiscal relief, cushioning domestic fuel prices and industrial costs.

Moreover, Turkish refineries can process this crude into high-value petroleum exports including diesel and jet fuel sold to European markets.

In effect, Turkey, like India, may re-export “Russian molecules” in different forms, blurring the lines of sanctions enforcement.

A Diplomatic Balancing Act

Ankara insists that its energy decisions are purely economic, not ideological.

But geopolitically, the move strengthens its position as a swing state balancing NATO membership with deepening ties to Russia, China, and the Middle East.

This flexibility has long defined Erdoğan’s foreign policy:

- Hosting Russian gas projects like TurkStream.

- Mediating grain deal negotiations between Kyiv and Moscow.

- Pursuing defense cooperation with both the U.S. and Russia simultaneously.

“Turkey’s foreign policy operates in shades of gray, not black and white,” says Sinan Ülgen, a former Turkish diplomat and Carnegie Europe scholar. “By keeping Russian oil flowing, Ankara preserves leverage both in Moscow and Washington.”

This approach mirrors India’s stance: engage all sides, align with none a 21st-century variant of non-alignment driven by energy pragmatism.

Western Reaction: Concern, Not Confrontation

While the U.S. and EU expressed “concern” over Turkey’s move, neither is likely to impose hard sanctions.

Unlike India, Turkey is deeply embedded in NATO and EU trade networks. Punishing Ankara could backfire, pushing it further toward Moscow or Beijing.

Instead, Western officials are expected to quietly negotiate energy carve-outs, just as they did with India, acknowledging that realpolitik trumps moral posturing.

A senior EU diplomat told Reuters anonymously: “We understand Turkey’s energy needs. The priority is keeping Ankara engaged within the Western orbit, not isolating it.”

This hands-off response underscores the declining leverage of sanctions as a foreign policy tool when major economies openly defy them.

Comparative Context: Turkey vs India in Energy Diplomacy

| Aspect | India | Turkey |

|---|---|---|

| Oil imports from Russia | ~35% of total | ~20% of total (and rising) |

| Payment mechanism | Rupee-ruble, third-party intermediaries | Exploring yuan/lira trade |

| Strategic role | Major refiner, re-exporter to EU | Transit hub & refiner |

| Western response | “Understanding but watchful” | “Concerned but cautious” |

| Regional focus | Indo-Pacific energy autonomy | Eurasian transit & NATO balance |

This comparison shows a convergence of economic pragmatism both countries using their geographic and diplomatic leverage to secure energy independence.

Expert Analysis: A Pragmatic New Order

Dr. Gulce Yildirim of Ankara Policy Centre told GeoEconomic Times:

“Turkey has realized what India did earlier that energy policy defines foreign policy. The era when the West dictated energy morality is over. Nations are reclaiming agency.”

Meanwhile, Indian energy analyst Vandana Hari notes that this alignment could create a “soft coalition” of oil-importing democracies from India to Turkey to Indonesia advocating for diversified supply chains outside OPEC and Western controls.

This shift, she argues, may permanently reshape global energy governance, giving middle powers more say in pricing, logistics, and contracts.

Future Scenarios: What Lies Ahead

- The “Energy Non-Alignment” Era Deepens

Countries like Turkey, India, and Brazil may institutionalize trade mechanisms outside the U.S. dollar, accelerating de-dollarization trends in energy trade. - Russia Diversifies Eastward Permanently

With Europe closed, Moscow’s pivot toward Asia and the Middle East will cement new dependencies especially through discounted long-term deals. - U.S.-Turkey Tensions Flare Intermittently

Washington may pressure Ankara on other fronts (defense exports, Syria policy) instead of direct energy sanctions. - Eurasian Economic Corridor Strengthens

As BRICS+ expands, Turkey’s inclusion already under discussion could integrate it into a parallel economic ecosystem linking Moscow, New Delhi, Riyadh, and Beijing.

Conclusion: The New Realism in Global Energy

Turkey’s decision to keep buying Russian oil is not an act of rebellion it’s a statement of realism.

Like India, Ankara recognizes that the post-Ukraine world is not about ideological alignment but strategic self-interest.

Both nations, though vastly different in geography and alliances, share a common vision: energy independence, economic pragmatism, and sovereign diplomacy.

As the Western-led global order evolves into a multipolar mosaic, countries like Turkey and India are emerging as the architects of a new global energy equilibrium one defined not by sanctions or superpowers, but by sovereignty and strategy.

Abhi Platia is a financial analyst and geopolitical columnist who writes on global trade, central banks, and energy markets. At GeoEconomic Times, he focuses on making complex economic and geopolitical shifts clear and relevant for readers, with insights connecting global events to India, Asia, and emerging markets.