Japan is once again at a crossroads. As the ruling Liberal Democratic Party (LDP) prepares for its leadership vote, markets in Tokyo and across Asia are on edge. The outcome will determine who steps into the prime minister’s office and, more importantly, how the world’s third-largest economy navigates its delicate balance between fiscal stimulus, tax reforms, and monetary easing.

Unlike many other elections, Japan’s leadership contest carries outsized global weight. The reason is simple: Japan is both a financial safe haven and a major creditor nation. Its monetary decisions ripple across global markets, shaping bond yields, currency flows, and commodity demand.

The Stakes: Continuity or Change?

Japan’s economy is facing an unusual mix of challenges:

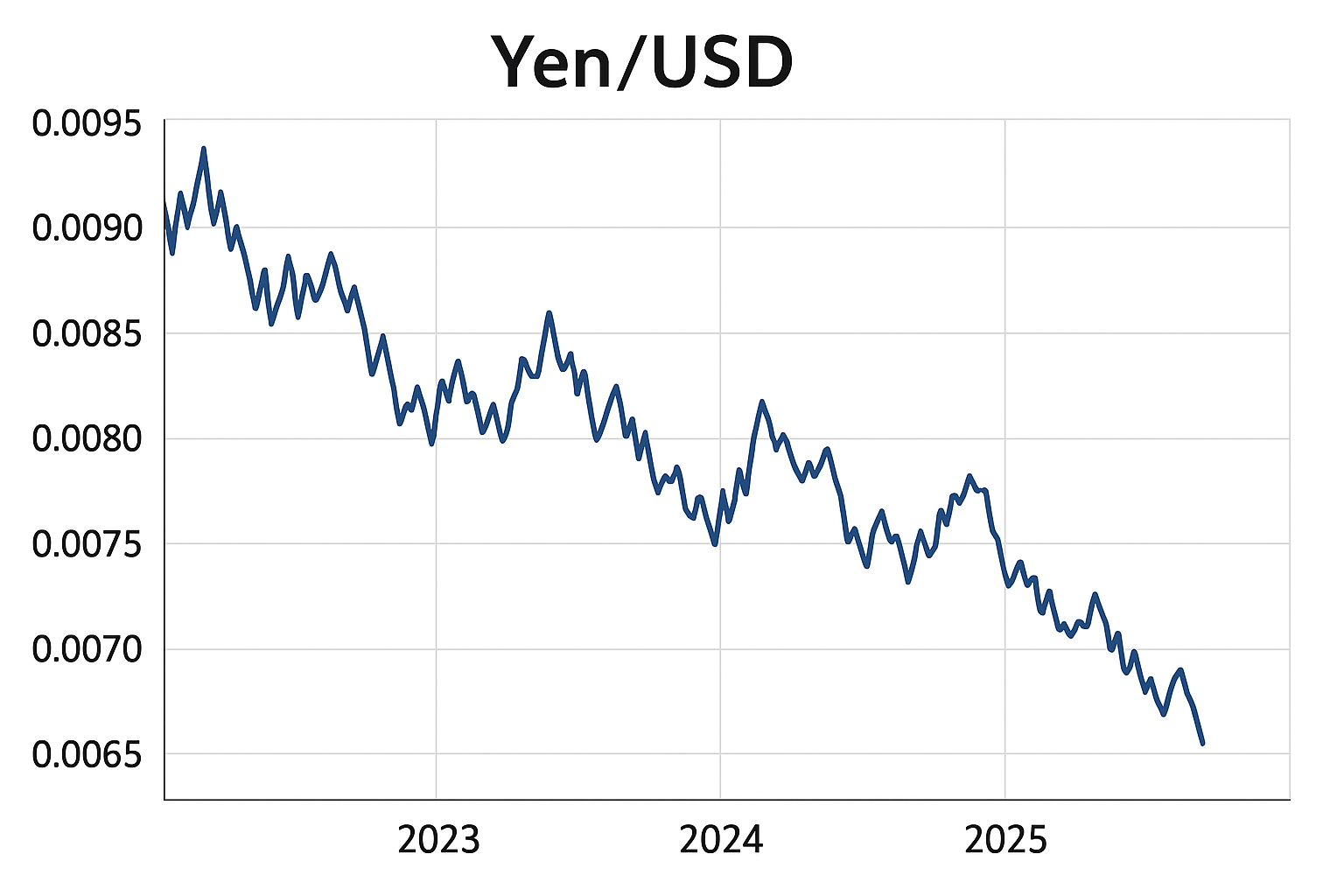

- Weak yen: The currency has lost over 30% of its value against the U.S. dollar since 2021, testing the limits of household purchasing power.

- Stubborn inflation: Consumer prices remain elevated at around 3%, high by Japanese standards after decades of deflation.

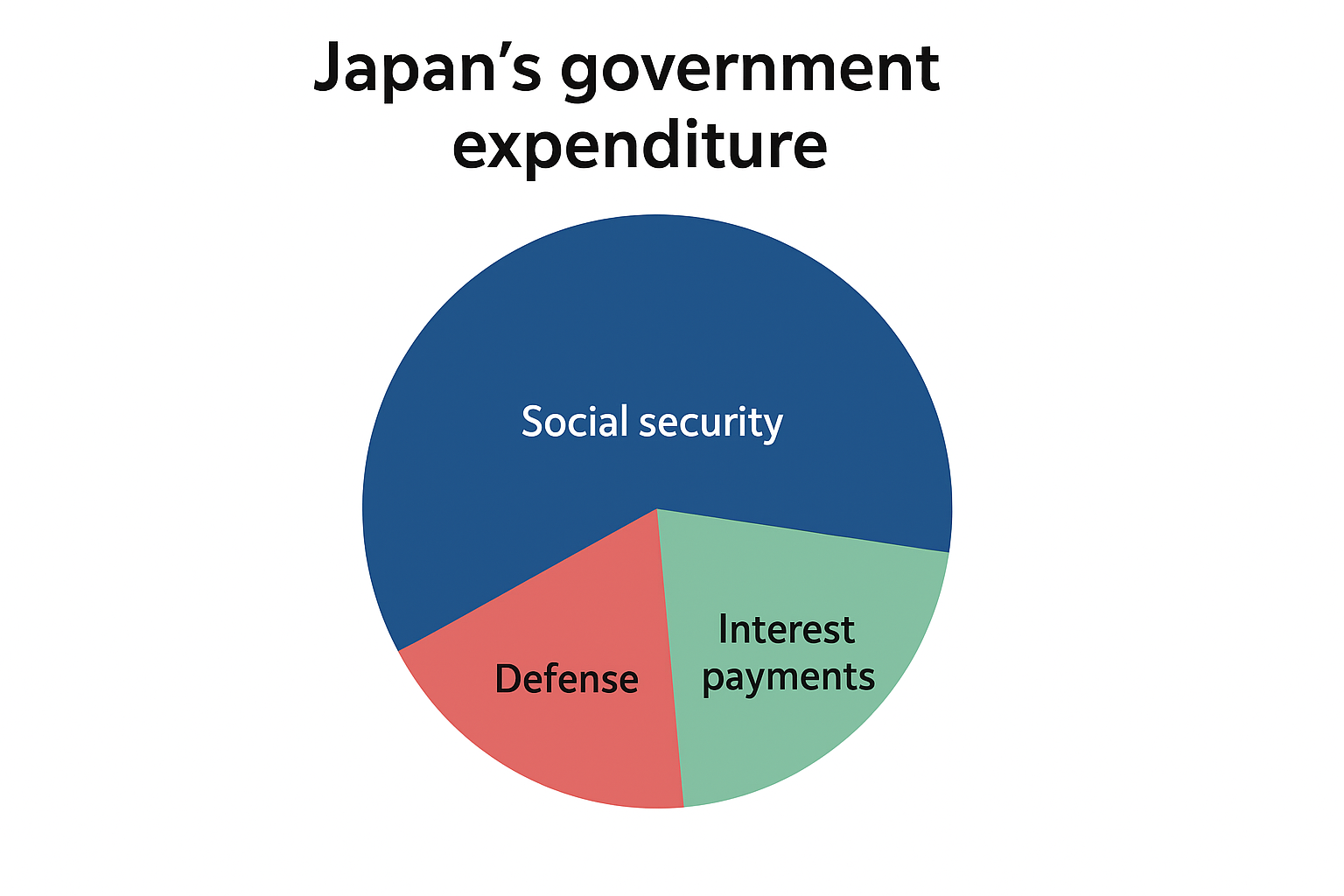

- Fiscal stress: Japan’s debt-to-GDP ratio, hovering near 260%, is the highest among advanced economies.

- Demographic drag: A rapidly aging population strains public finances and reduces productivity growth.

The next LDP leader inherits these structural pressures, with little margin for error.

Candidate Policy Positions

While the full lineup of candidates is still evolving, two broad policy camps are visible:

- The Continuity Camp – aligned with current Bank of Japan (BOJ) Governor Kazuo Ueda’s ultra-loose monetary policy, favoring continued stimulus and resisting sharp interest-rate hikes.

- The Reformist Camp – more open to fiscal consolidation, gradual tightening of monetary policy, and potential tax adjustments to stabilize long-term debt.

This divergence matters because Japan’s past decade was defined by “Abenomics” massive monetary easing, fiscal pump-priming, and structural reform. Whether that continues or shifts will shape markets from Tokyo to New Delhi.

Markets React: Yen, Bonds, and Equities

Financial markets are already pricing in uncertainty:

- Yen volatility: Traders are hedging against sharp swings depending on leadership signals about BOJ policy.

- Government bonds (JGBs): Investors fear that any move away from yield-curve control could spike borrowing costs for the government.

- Equities: Export-driven companies favor a weak yen, but domestic-facing firms worry about rising input costs.

“The Japanese leadership race is less about personalities and more about credibility with markets,” says Takashi Nakagawa, senior strategist at Nomura Securities. “If investors sense hesitation or disorder, capital outflows will accelerate.”

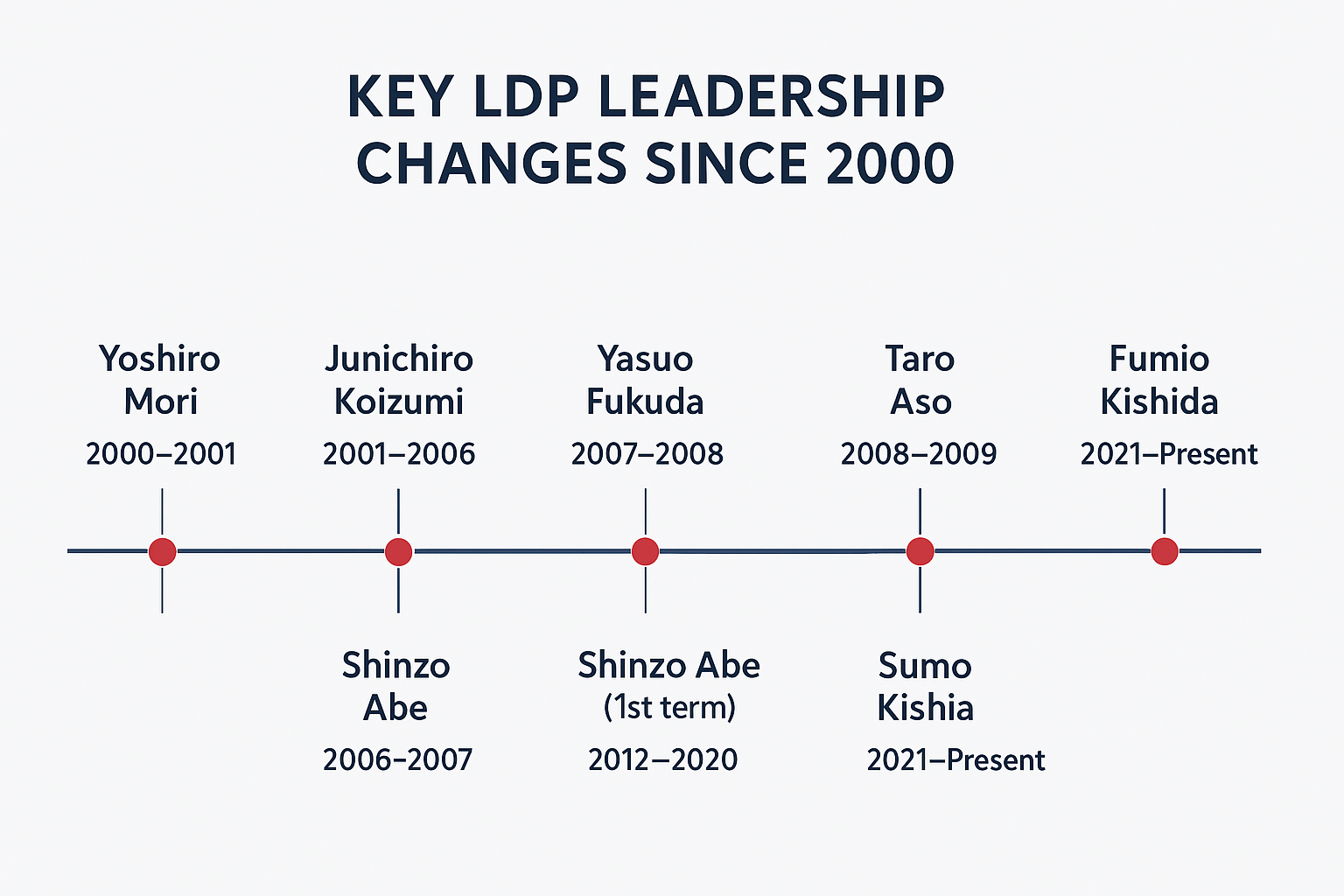

Historical Echo: From Koizumi to Abe

Japan has been here before. In the early 2000s, Prime Minister Junichiro Koizumi pushed reforms that temporarily restored confidence in fiscal discipline. A decade later, Shinzo Abe revived Japan’s economic profile with his bold monetary experiment.

The current moment resembles both eras: the need for credible reform (like Koizumi) and the urgency of decisive stimulus (like Abe). Yet, unlike those periods, today’s global environment is far more fragmented with U.S. interest rates high, China slowing, and energy prices volatile due to geopolitical shocks.

Asia and Global Consequences

The leadership vote is not just a domestic affair. Here’s how it plays out globally:

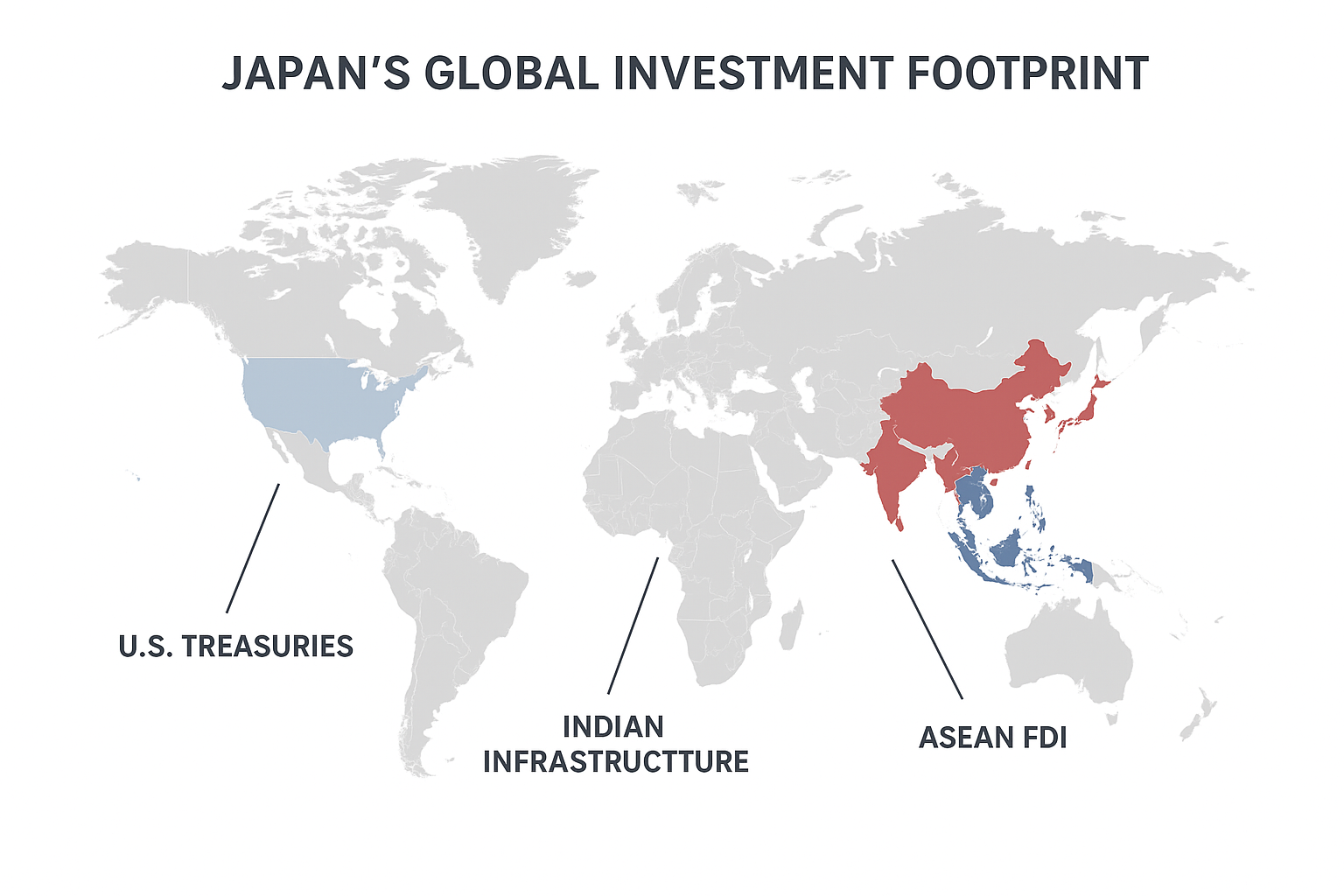

- India: As a major importer of Japanese capital, India’s infrastructure projects rely on low-cost Japanese financing. A leadership turn toward fiscal tightening may reduce outflows into Indian bonds and infrastructure loans.

- Middle East: Japan is a top buyer of Gulf oil. Any economic slowdown or yen weakness could alter demand, impacting Saudi and UAE fiscal revenues.

- China: Amid deteriorating Sino-Japanese relations, Beijing watches closely. A leader aligned with Washington could deepen Japan’s role in semiconductor export controls, reshaping Asian supply chains.

- Global markets: Japan holds over $1 trillion in U.S. Treasuries. If leadership shifts trigger JGB volatility, Tokyo may reduce foreign holdings, pushing U.S. yields higher.

Data Snapshot

Japan’s Fiscal and Monetary Position (2025)

- Debt-to-GDP: 259%

- BOJ policy rate: 0–0.1%

- Inflation: 3.1%

- Yen (USD/JPY): 148.7

- FX reserves: $1.25 trillion

(Sources: IMF, BOJ, Japanese MoF)

Possible Scenarios After the Vote

- Stimulus Continuity Scenario

- New PM doubles down on fiscal stimulus and BOJ easing.

- Short-term growth supported, yen weakens further.

- Risk: bond market revolt, imported inflation.

- Reformist Adjustment Scenario

- Gradual fiscal consolidation, modest BOJ tightening.

- Yen strengthens, households benefit from cheaper imports.

- Risk: export sector weakens, markets skeptical of pace.

- Political Gridlock Scenario

- Leadership divided, policy muddled.

- Confidence falls, foreign investors retreat.

- Risk: capital outflows, rising borrowing costs, political instability.

Expert Views

- Mariko Fujiwara, Policy Research Institute (Tokyo):

“Japan’s challenge is walking the tightrope stimulating enough to sustain growth but signaling fiscal credibility. The leadership vote is a referendum on which side of the rope to tilt.” - Dr. Rakesh Mohan, former RBI Deputy Governor (India):

“For India, Japanese financing is critical. A hawkish turn in Tokyo could mean costlier infrastructure loans and tighter credit conditions.” - Middle East analyst, Dubai-based Gulf Economic Forum:

“Japan’s energy demand trajectory directly influences OPEC+ decisions. If Japan signals lower consumption, Saudi Arabia will recalibrate production.”

Geopolitical Angle: U.S.–Japan Alliance

Beyond economics, the leadership vote also determines Tokyo’s foreign policy stance. A hawkish prime minister may deepen alignment with Washington on security, technology, and sanctions policy. That could heighten tensions with China and Russia but strengthen Japan’s voice in G7 diplomacy.

Opinion: Why This Vote Matters More Than Usual

Japan’s leadership turnover has been frequent in recent decades, often dismissed as “revolving-door politics.” But today’s vote is different. With inflation returning, the yen under pressure, and fiscal risks mounting, the decision will shape Japan’s trajectory for the next decade.

Unlike past elections, this is not just about personalities it’s about whether Japan can transition from an era of endless stimulus to one of cautious normalization without breaking market confidence.

Conclusion: Watching the Yen, Watching the Vote

For investors, policymakers, and neighbors alike, the signal to watch is the yen. If it stabilizes post-vote, confidence in Japan’s leadership will be confirmed. If it tumbles, markets will doubt Tokyo’s capacity to navigate its challenges.

The LDP leadership race is therefore not just a domestic political contest it is a global financial event. Its outcomes will shape currency markets, Asian trade flows, and even the global energy equation.

In the end, Japan’s political decision could well redefine Asia’s economic landscape for years to come.

Abhi Platia is a financial analyst and geopolitical columnist who writes on global trade, central banks, and energy markets. At GeoEconomic Times, he focuses on making complex economic and geopolitical shifts clear and relevant for readers, with insights connecting global events to India, Asia, and emerging markets.