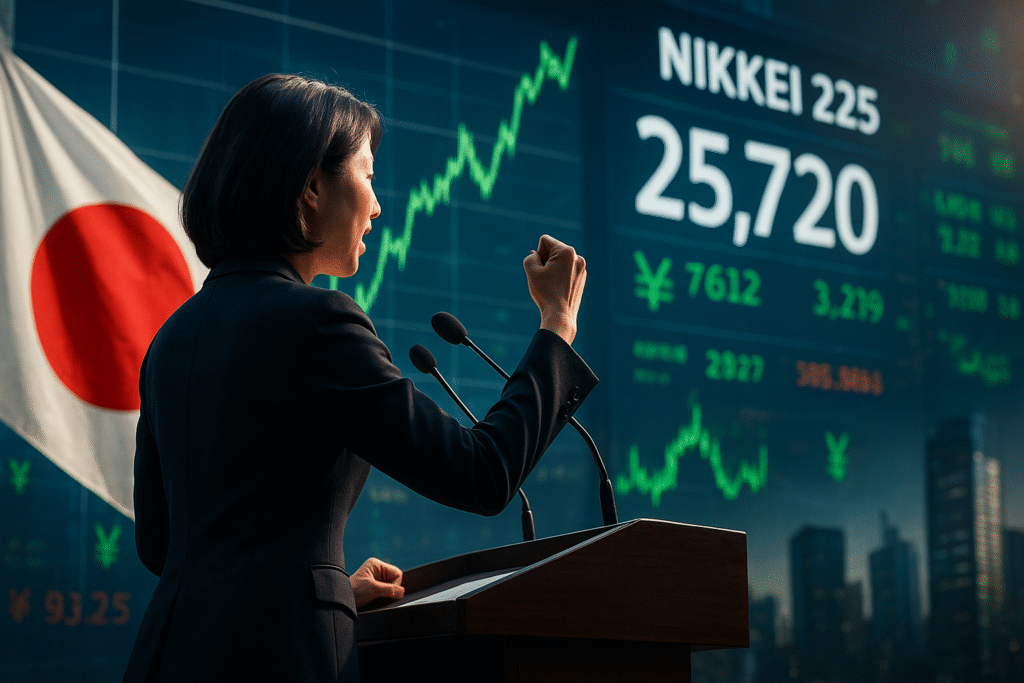

Japan’s financial markets exploded higher after Sanae Takaichi was elected leader of the ruling Liberal Democratic Party (LDP), paving her path to becoming Japan’s first female prime minister. Within hours, the Nikkei 225 surged by nearly 5 percent, while the yen collapsed a clear sign that investors are betting on aggressive stimulus, delayed interest-rate hikes, and renewed growth momentum.

This move isn’t just a market whim. It signals a structural shift in expectations for Japan’s fiscal and monetary policy and by extension, Asia’s capital flows. Below is a deep dive into the forces behind the rally, the dangers ahead, and what this means for India, the wider region, and global investors.

1. The Catalysts: Why the Rally Was Explosive

A. The “Takaichi Trade” Gains Traction

Takaichi’s win revived the so-called “Takaichi trade” long equities, short yen, bearish long-duration Japanese government bonds (JGBs). Analysts had already positioned for her victory, and markets aggressively unwound bets against her.

Her election is viewed as a mandate for expansionary fiscal stimulus and continued pressure on the Bank of Japan (BOJ) to suppress rate hikes.

B. Yen Weakness & Export-Biased Gains

The yen slid almost 2 percent versus the dollar, weakening past the ¥150 mark, as the market priced in delayed tightening.

A weaker yen amplifies export competitiveness and draws foreign capital into equities. But it also threatens import-driven inflation, especially for a country dependent on energy and raw materials.

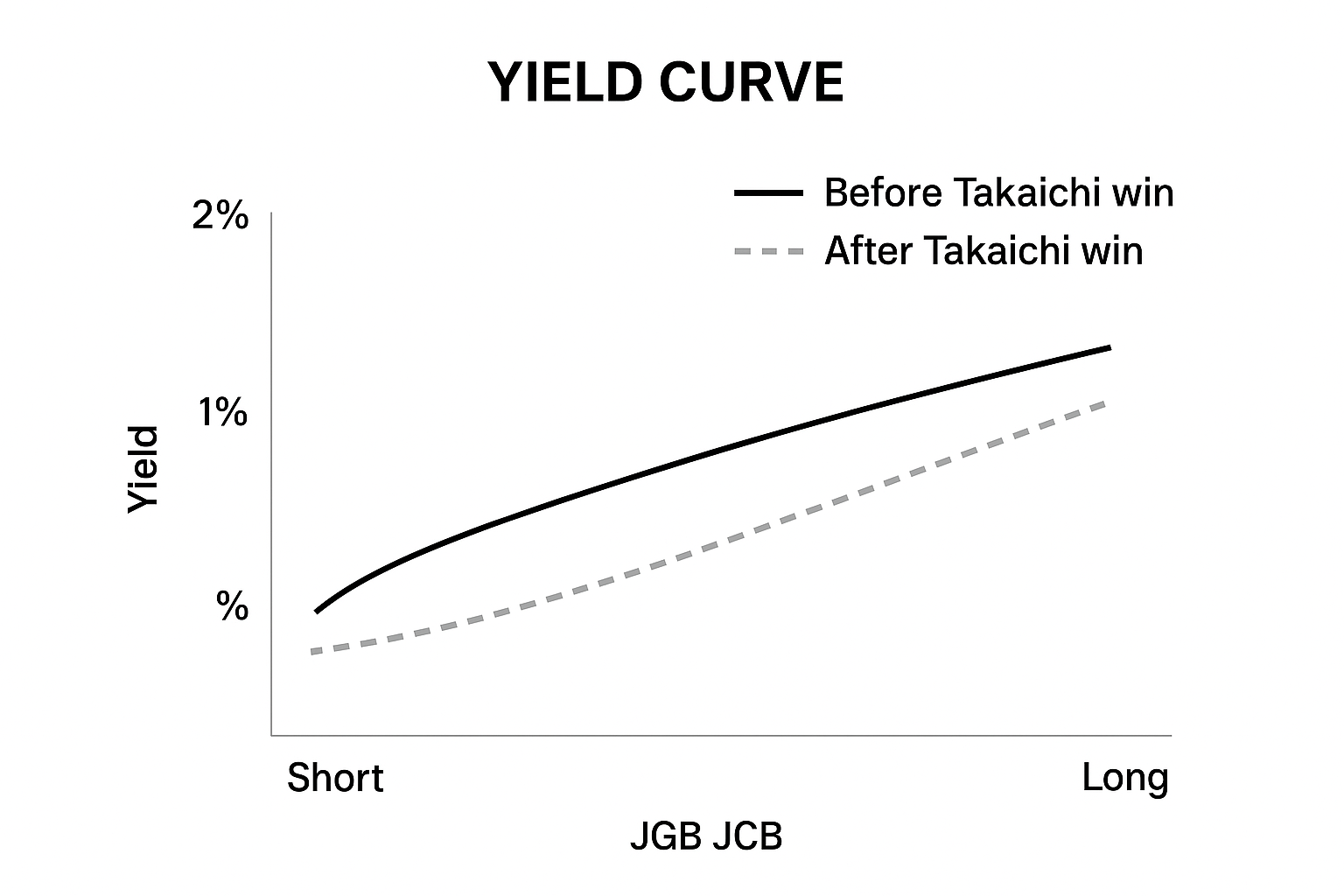

C. Yield Curve Steepens, Bonds Wobble

Long-term yields, especially 30- and 40-year JGBs, jumped as bond markets anticipated heavier government issuance. The 40-year JGB yield hit ~3.54 percent.

Meanwhile, shorter yields softened reflecting market bets that the BOJ won’t raise rates imminently. This steepening of the curve is central to the “growth over yield” narrative.

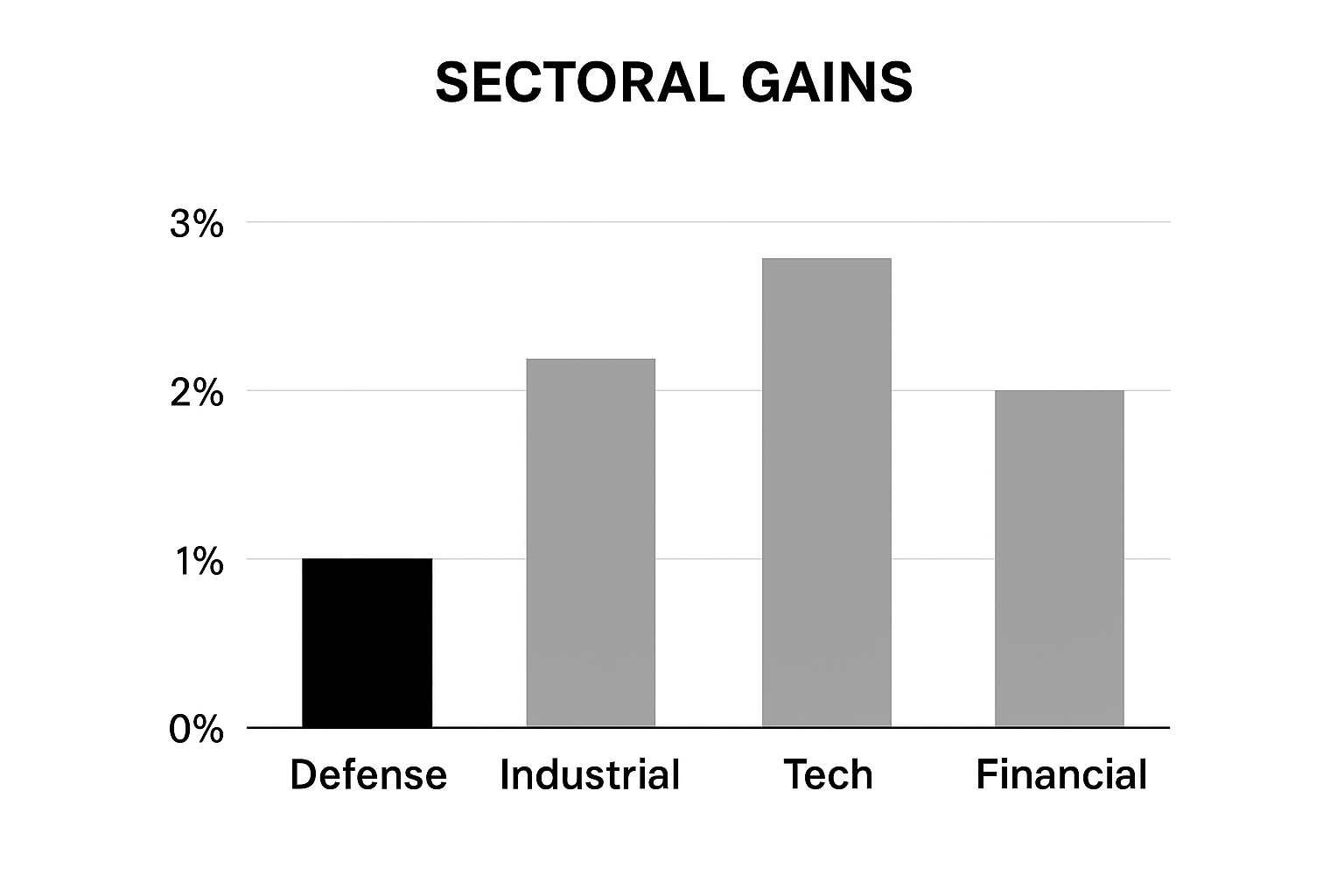

2. Magnitude & Market Moves: Which Sectors Led?

- The Nikkei 225 closed at 48,051.32, up nearly 5 percent.

- The Topix index rose ~3.3 percent.

- Defense and industrials were among the stars Mitsubishi Heavy jumped 12 percent; Japan Steel Works surged 14 percent.

- Financials lagged, as rate cuts expectations dented banking margins.

This divergence underscores the market’s tilt: long bets on growth, shorter bets on interest rate pain for banks.

3. Policy Signals: How Deep Will the Stimulus Go?

Takaichi’s agenda is ambitious and depends greatly on her cabinet and BOJ cooperation.

Tolerating a Hike?

One of her key economic advisers, Takuji Aida, remarked she may tolerate a 25 basis-point rate hike by January provided the BOJ maintains an overall loose stance until 2027.

This gives her a “grace window” of flexibility but it’s contingent on wage growth, inflation, and political alignment in the Diet.

Big Sectors of Focus

Her platform is centered on strategic investment:

- AI and semiconductors

- Defense & security tech

- Nuclear power & advanced energy

- Infrastructure and “crisis management” spending akin to a new wave of Abenomics

But critics caution: without complementary revenue measures or fiscal consolidation, the debt burden may ravage bond markets over time.

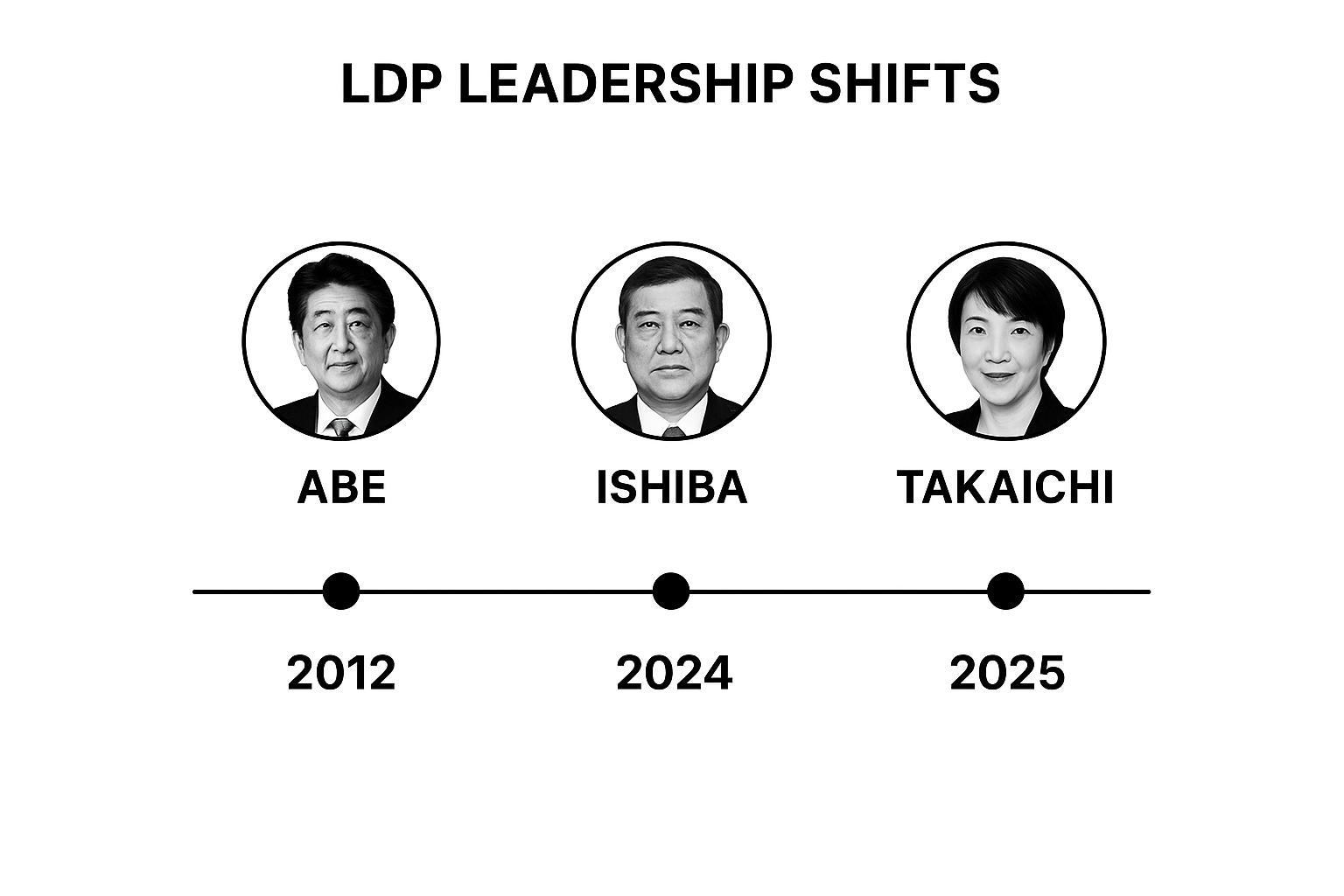

4. Historical Comparisons & Lessons from Past Leadership Jumps

Japan has seen leadership changes jolt markets but seldom so dramatically.

- When Shinzo Abe first came to power in 2012, markets rallied on structural reform hopes. But execution lagged.

- The 2024 LDP leadership election that brought in Ishiba was met with uncertainty and muted response.

- Under Takaichi, the contrast is stark: markets are not waiting they’re reacting first, believing her policy direction will prioritize growth and assertive fiscal measures.

Yet, past narratives warn: investor enthusiasm can outpace policy delivery. Political pushback, fragile coalition dynamics, or sedate execution can blunt that exuberance.

5. Regional & India Angle: Where the Ripples Reach

India: Competing for Capital, Cooperation in Policy

- Floated capital may flow into Japan, but sectors like tech, defense, and energy often see cross-investment and joint ventures. Takaichi’s stimulus focus may invite deeper Japan–India industrial collaboration.

- India must balance: export opportunities if Japan relaxes trade barriers, and capital flight risk if Japanese assets look more attractive.

- Given India’s strategic push in semiconductors, Japan under a stimulus regime may seek partnerships or co-investment in South Asia.

East & Southeast Asia

- Malaysia, South Korea, Taiwan, and Vietnam will watch closely. Tokyo’s stimulus may pull capital eastward and alter regional supply chains, especially in electronics and defense.

- The China–Japan dynamic may intensify: Tokyo could lean harder into defense posture and secure supply chains away from Chinese influence.

Global Sentiment & Carry Trade

The weaker yen enhances its role as a funding currency in global carry trades, amplifying stress and spillovers if USD rebounds.

Meanwhile, other emerging markets may see inflows diverted to Japan temporarily, depending on regional yield differentials.

6. Risks & Red Flags: Why This Rally Isn’t Guaranteed

Debt & Fiscal Backlash

Japan’s debt-to-GDP is already over 260 percent. Any misstep or loss of confidence in government issuance can rattle markets.

If bond yields rise faster than growth, Japan may face a fiscal crisis by the back end of the decade.

Currency Volatility & Import Pain

A persistently weak yen makes imports energy, food, raw materials costlier. Wage growth may lag, sparking social drag.

This may force sudden policy pivots or surprise rate responses by the BOJ.

Execution & Political Constraints

Takaichi’s majority in the Diet is not yet ironclad. Passing large stimulus bills, constitutional amendments, or controversial reforms will require coalition finesse.

Delays or half-measures could disappoint markets and trigger reversals.

Overheating & Speculation Bubbles

Rapid capital inflows may stoke speculative excess. If some sectors overextend, a sharp correction is possible especially if global risk sentiment reverses.

7. Scenarios: Paths Japan Could Take

| Scenario | Likelihood | Outcome |

|---|---|---|

| Bold Stimulus & Growth Lift | Moderate | Nikkei adds 10–15%, yen remains weak, capital inflows grow |

| Measured Implementation | High | Phased stimulus, cautious BOJ, modest gains |

| Disappointment / Pullback | Moderate | Rally stutters, yields spike, risk aversion resurfaces |

In a balanced view, we’re likely in “Measured Implementation” mode: markets will test limits, pressure government, but expect gradual execution rather than rapid overhaul.

8. Voices from the Market

“Even though BOJ hike bets are fading, the yen will remain under pressure until policy clarity arrives,” says Shoki Omori, Chief Desk Strategist at Mizuho Securities. Reuters

David Chao, Invesco’s Asia-Pacific strategist, points out: “Takaichi has expressed flexibility on rate hikes, so markets may eventually reprice some tightening but within a constrained range.”

Aninda Mitra, Head of Asia Macro Strategy, notes: “Uncertainty in fiscal ambition and monetary coordination will be a drag on yen and JGB sentiment.”

In a private note, a Tokyo-based quant fund manager said: “We’re loading up export and defense bets but maintaining protective stops. This still feels like a policy trade, not structural re-rating yet.”

10. Conclusion: Excitement With Caution

Japan’s market rally is a dramatic reaction not just to a new leader, but to the promise of renewed growth, stimulus, and risk-taking. Yet every rally carries inherent dangers: fiscal overreach, currency stress, and political gridlock may check momentum.

For India and Asia, this moment is a turning point. Tokyo’s new posture could reset trade, investment, and alliances across the region.

If Takaichi delivers with credibility, Japan may recapture growth and market confidence. If she falls short, markets will likely reverse as hard as they advanced.

Either way, this chapter will be pivotal in Asia’s financial story for 2025 and beyond.

Abhi Platia is a financial analyst and geopolitical columnist who writes on global trade, central banks, and energy markets. At GeoEconomic Times, he focuses on making complex economic and geopolitical shifts clear and relevant for readers, with insights connecting global events to India, Asia, and emerging markets.