It was a quiet weekend until Donald Trump decided it wouldn’t be.

Just hours after the U.S. markets closed on Friday, Trump unleashed a surprise announcement: new tariffs of up to 100–130% on Chinese imports, accusing Beijing of “economic aggression” and “strategic sabotage.”

Within minutes, the shockwave spread.

Asian markets opened in deep red. Bitcoin fell over 10% overnight, wiping out nearly $1 billion in value one of the steepest crypto sell-offs in recent history. U.S. tech giants like Tesla, Amazon, and Nvidia saw their futures plummet, collectively erasing more than $1.6 trillion in market capitalization within 24 hours.

It wasn’t just a market move. It was a message one that carried political heat, economic fire, and global consequences.

The Trigger: Anger, Politics, and the Nobel Snub

Trump’s critics argue this outburst was not purely economic it was personal.

Just a week earlier, the Nobel Peace Prize Committee had announced its 2025 laureate, and Trump’s name was missing.

The White House reacted furiously. Communications Director Mike Peterson publicly accused the Nobel Committee of being “politically compromised,” saying, “They’ve proven that politics outweighs peace.” Pro-Trump lawmakers went even further some sarcastically thanked Russian President Vladimir Putin for “exposing the Western hypocrisy of peace awards.”

But Trump’s anger didn’t stop at words.

Within days, he shifted the conversation from peace prizes to trade wars, targeting China America’s biggest economic rival as if to reclaim control over the narrative.

As one Washington insider put it:

“When Trump feels sidelined, he doesn’t retreat he retaliates.”

The New Tariffs: 100–130% A Trade War 2.0

Trump’s order expands the previous tariff regime from 30% to a staggering 100–130% on key Chinese goods, especially in electronics, automotive components, and rare-earth-dependent items.

According to a leaked White House memo reviewed by several outlets, the move aims to “protect American manufacturing and punish strategic manipulation of mineral supply chains.”

But here’s the twist:

China had just begun tightening exports of rare earth elements the critical materials used in everything from electric vehicles to fighter jets and was reportedly demanding that countries receiving Chinese rare earths not resell or re-export them to the U.S.

For Washington, that was the last straw.

For Beijing, this was provocation.

China’s Counterplay: Rare Earths and Air Routes

In response, Chinese media outlets have already started hinting at countermeasures, from limiting technology exports to revising air travel permissions.

Here’s the under-reported piece:

China’s airlines currently fly to the U.S. using Russian airspace, saving both time and fuel. U.S. carriers can’t do that Washington’s relations with Moscow remain frosty.

So now, American senators are proposing a retaliatory move banning any Chinese flight that uses Russian air routes from landing in the U.S.

This could open a whole new front: the “Air Corridor War.”

“It’s symbolic not just about routes, but about alliances,” says Dr. Emily Chow, Senior Fellow at the Asia Trade Institute (Singapore). “If U.S. bans these flights, China will retaliate elsewhere, maybe in tech exports, maybe in diplomacy.”

Markets React: Panic or Pattern?

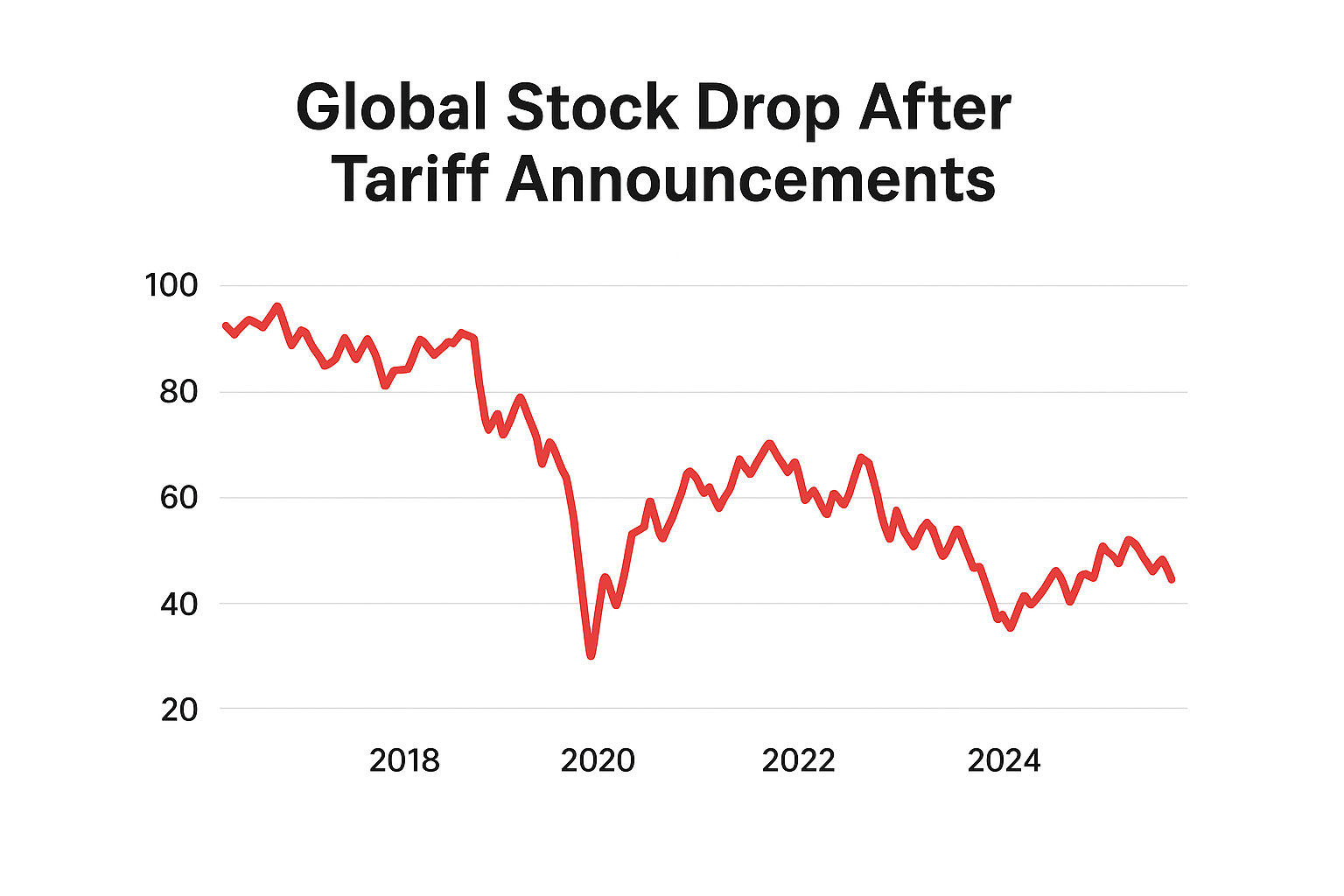

For investors, the déjà vu is real.

The last time Trump imposed massive tariffs on China, in 2018, global stock markets lost over $5 trillion in value within six months, and supply chains never fully recovered.

But analysts warn: this time it’s different.

In 2025, the global economy is already under strain inflation is cooling in the U.S., but energy prices are volatile, and the yuan has strengthened. Any major disruption could tip developing economies into stagflation.

A recent JPMorgan Global Markets Report noted:

“If tariff escalation continues into Q4 2025, we could see a 0.8–1.1% reduction in global GDP. The dollar remains strong for now, but the long-term trend suggests increasing de-dollarization pressure.”

India’s Balancing Act: Opportunity and Risk

For India, the crisis is a double-edged sword.

On one side, U.S.-China tensions open strategic space for India’s manufacturing ambitions. Washington could divert investments and supply chains to New Delhi especially in semiconductors, critical minerals, and defense tech.

Already, American firms like Micron and Texas Instruments are scouting expansions in Gujarat and Tamil Nadu.

But there’s danger too.

China’s restrictions on rare earths materials India still imports in large quantities could inflate local production costs. And if Beijing enforces its “no re-export to the U.S.” clause, New Delhi may find itself walking a tightrope between two superpowers.

A senior analyst at Delhi’s Observer Research Foundation (ORF) told Global Lens:

“India cannot afford to choose sides. The real play is to use this chaos to attract capital, without becoming collateral.”

Timeline: The U.S.-China Economic War at a Glance

| Year | Event | Key Impact |

|---|---|---|

| 2018 | Trump’s first tariffs on Chinese steel & tech | Trade war begins; markets drop |

| 2020 | Pandemic & supply chain disruption | Global production realigns |

| 2023 | China limits rare earth exports | Rising costs in EV and defense |

| 2025 | Trump returns, raises tariffs to 100%+ | “Trade War 2.0” begins |

Expert Reactions: Anger, Strategy, and Theater

Paul Kruger, Chief Economist at the Brookings Forum, says:

“Trump isn’t just targeting China he’s targeting Wall Street. Market panic feeds his narrative that only he can fix America’s economy.”

Meanwhile, Dr. Ayesha Rehman, analyst at the Islamabad Centre for Strategic Futures, adds:

“The timing matters Trump’s Nobel rejection, his base’s anger, and the APEC Summit all converge. It’s both political theater and geopolitical recalibration.”

Even within China, commentary is turning sharp. The Global Times called Trump’s tariffs “a desperate attempt to weaponize decline.”

Opinion: What Comes Next

If the 2018 trade war was a slow burn, 2025 feels like an explosion.

Trump’s unpredictability now combines with a more assertive Beijing, a cautious Moscow, and a divided West.

Three possible scenarios emerge:

- Negotiated Calm: Both sides signal toughness but quietly renegotiate before APEC in Seoul.

- Escalation Spiral: China retaliates by banning rare earth exports; the U.S. expands tariffs to consumer goods.

- Market Manipulation Play: Trump leverages panic to tank and re-buy U.S. markets before declaring “victory.”

India’s Window of Opportunity

India’s diplomatic agility will be tested.

PM Modi is scheduled to attend the 2025 APEC Summit in South Korea where Trump, Xi Jinping, and Putin may all appear. For New Delhi, this summit could decide the future balance: Can India become the neutral trade hub the world now needs?

As one Indian diplomat put it privately:

“If the U.S. and China go to war economically or otherwise the world will need a third stabilizer. That stabilizer could be India.”

Conclusion: The World After the Bomb

The “economic bomb” Trump dropped on China is more than policy it’s performance.

But behind the drama lies a real danger: the fracturing of global trade stability that held since World War II.

From Silicon Valley to Shenzhen, from Mumbai to Moscow, the tremors are already visible.

And once again, it all started with a weekend tweet.

Abhi Platia is a financial analyst and geopolitical columnist who writes on global trade, central banks, and energy markets. At GeoEconomic Times, he focuses on making complex economic and geopolitical shifts clear and relevant for readers, with insights connecting global events to India, Asia, and emerging markets.