In a surprising turn during his latest address, Donald Trump claimed that Prime Minister Narendra Modi personally assured him that India will fully stop purchasing Russian oil. The assertion has sent ripples across New Delhi, Moscow, and the global energy markets. Trump even added, with dramatic flair, that he doesn’t wish to ruin Modi’s political career yet his words carry weight that could trigger serious diplomatic consequences.

Is this claim grounded in reality, or part of Trump’s rhetorical theater? What would it mean if it were true? And how might this play out in the larger game of geopolitics, especially between India, Russia, the U.S., and China? Let’s unpack the narrative, compare to history, and forecast possible outcomes.

What Trump Is Saying And Why It Raises Eyebrows

Trump’s comments emerged during a press interaction where he pivoted from discussions about Iran and Pakistan to India. In his account, he said:

“Modi told me: no more oil from Russia. He has agreed. I’m not saying this to end his political career but that’s what he said.”

He followed it with:

“India is a great nation. But we also need energy security. If Russia is undermining, you stop buying from them that’s what a smart leader does.”

He further tangled the narrative by mixing Iran and Pakistan; at one point, he claimed he had negotiated a peace deal there, then pivoted to India in the same breath, suggesting he sometimes confuses his geopolitical scripts but insisted his message remains clear.

The dramatic timing of the announcement just weeks after Modi’s international visits and a period when India’s energy imports were under scrutiny suggests caution: either it’s a pressure tactic or a reveal of behind-the-scenes diplomacy.

India’s Official Response: Cautious and Noncommittal

Within hours of Trump’s remarks, MEA Spokesperson Arindam Bagchi issued a restrained statement:

“India is a major importer of oil and natural gas. Our energy sourcing is guided by strategic interests. We are engaged in diversifying suppliers and ensuring price stability. We will not comment on speculative claims.”

This measured approach reflects Delhi’s long-held positioning: strategic autonomy. India has always signaled that it won’t be pressured into policy changes by external statements.

Opposition voices, however, pounced. Former leaders questioned whether Modi had made any such promises at all, demanding transparency and clarity from the government.

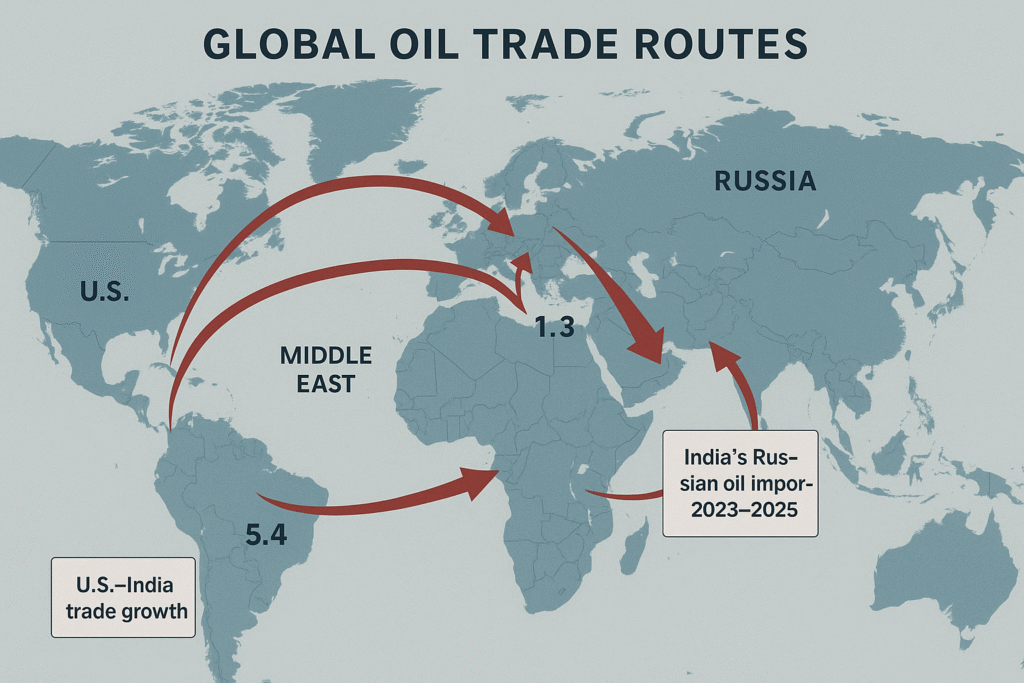

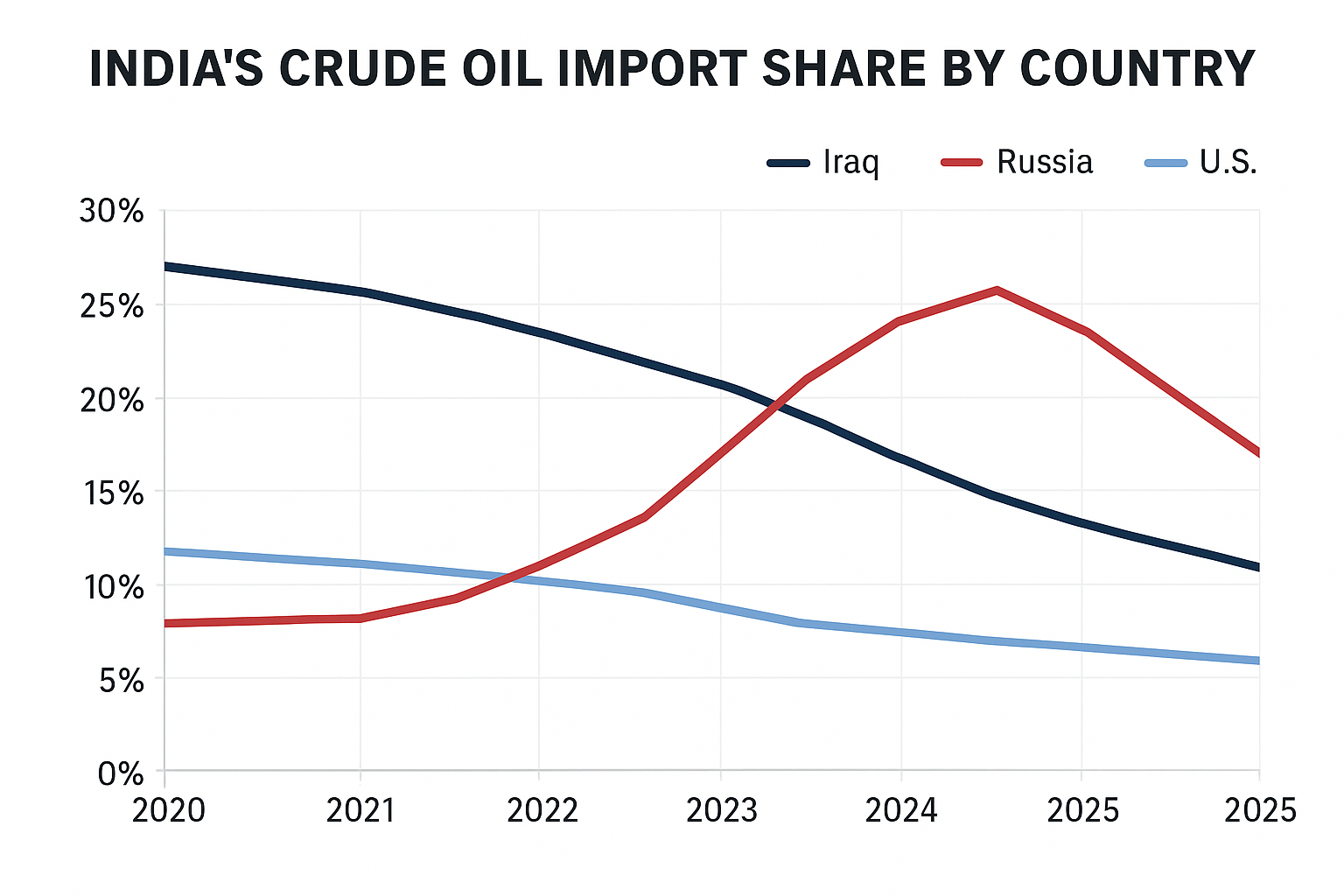

Facts and Figures: India’s Oil Imports from Russia

To understand how dramatic Trump’s claim might be, we must examine India’s import behavior:

- In mid-2023, India was importing nearly 1.2 million barrels per day (bpd) of Russian crude accounting for a significant share of its total monthly imports.

- By June 2025, that figure reportedly dropped to around 600,000 bpd, reflecting global price arbitrage, sanctions risk, and logistical difficulties.

- Internal trade data suggest that, as of September 2025, Indian refiners increased imports from the Middle East and the U.S., though Russia still remained one of the top three suppliers.

These figures reveal that India does already engage in partial diversification, not full exit making a “no oil from Russia” scenario ambitious.

Why Trump Would Make This Claim

- Political Leverage & Narratives

Trump’s base thrives on bold statements and dramatic narratives. By casting Modi as making a strong commitment, he positions himself as a global deal-maker. - Pressure on India’s Energy Policy

Washington increasingly seeks to reduce Russian oil flows globally. If the U.S. can claim India has committed, it can lobby European and Middle Eastern powers to tighten pressure on Moscow. - Shaping Perceptions Ahead of Elections

In American domestic politics, aligning India with U.S. foreign policy goals can be a talking point for Trump’s critics: “See, even Modi listened.” - Miscalculation or Mishearing

Given Trump’s past rhetorical missteps, it’s possible he misinterpreted a conversation or exaggerates for drama.

Historic Parallels: When Leaders Make Big Promises

Leaders announcing major foreign policy shifts are not new. Notably:

- In 2014, India’s then-PM Narendra Modi pledged new energy diplomacy to reduce dependence on Middle Eastern oil, but the actual shift was gradual and complex.

- In 1980s, Mexican presidents declared they would stop importing oil from certain U.S. companies as a posture, but actual trade realities forced moderation.

- More recently, countries under sanctions (e.g. Iran, Venezuela) often vow total import bans of certain goods yet in practice maintain workaround channels.

These examples show that public promises often become symbolic leverage, not immediate policy reversal. The real change, if any, comes in months or years, not days.

Scenarios if India Actually Stops Buying Russian Oil

If India were to follow Trump’s asserted commitment, the consequences would be massive:

Scenario A: Gradual Phase-Out with Safeguards

India could reduce Russian imports over 12–18 months while increasing procurement from Saudi Arabia, UAE, U.S., and Iraq. This gives time for refining, logistics, renegotiation. Price stability would be the top challenge.

Scenario B: Sudden Cut

If Modi abruptly stops Russian imports, Indian refineries could face supply shocks. Prices would spike, sectors would suffer, and global energy markets would react violently. Russia would lose one of its biggest clients, strengthening U.S. and European leverage.

Scenario C: Backtrack Under Pressure

Delhi may signal a cut, backpedal under domestic strain or geopolitical counterpressure, and resume a lower amount of Russian imports. This is perhaps most realistic, preserving flexibility and deniability.

Geopolitical Risks & Regional Angles

Impact on India–Russia Relations

India and Russia share a longstanding strategic relationship military hardware, diplomatic alignment in multilateral forums (BRICS, SCO). A cut would strain trust. Moscow may raise costs or impose penalties.

U.S., Israel, and Energy Diplomacy

If India aligns with U.S. pressure, it may improve Washington’s leverage in its ongoing Israel–Gaza diplomacy. India may be expected to tacitly support U.S. and Israeli narratives in multinational fora.

China Watch

Beijing is closely watching all shifts in Russia’s energy clients. A sudden drop by India could present China with opportunity: Russia may offer deeper discounts or technology transfers to China in compensation.

Middle East & Gulf States

Saudi Arabia and UAE see India as a key energy customer. If India pivots away from Russia, Gulf suppliers may demand higher pricing or reframe supply contracts, knowing India has fewer alternatives.

Expert Views & Voices

Dr. Shyam Saran, former Indian diplomat:

“India operates on strategic autonomy we do not take orders from others. If Modi ever made such a promise, it would be subject to conditions and energy security logic.”

Maria Lins, energy policy researcher, University of Oxford:

“The energy choices of large importers like India matter. If New Delhi truly stops buying from Russia, it could accelerate de-dollarization and push Europe to deepen alternatives.”

Russian diplomat (anonymous, Moscow):

“We see Trump’s statement as political posturing. India is far more pragmatic. If oil from us is cheaper and same quality, we will continue trade.”

What Numbers Might Reveal

- Import volumes: Watch monthly India customs data if Russian oil imports drop below 200,000 bpd from ~600,000, that is a real shift.

- Price differentials: If discounts from Russia narrow or vanish, it signals Moscow’s unwillingness to lose India.

- Contract reassignments: New long-term deals with Gulf, Iranian, or U.S. sources would confirm a pivot.

- Diplomatic cables or leaks: Any U.S.–India energy commitment in classified talks would be a smoking gun.

Conclusion: A Bold Claim, But Is It Realistic?

Trump’s explosive statement has certainly grabbed global attention. But the gap between promise and execution is vast in energy geopolitics.

India is one of the world’s biggest energy importers. Cutting off a major supplier one offering favorable rates would require not just political will but economic planning, infrastructure realignment, and diplomacy.

For now, Delhi’s measured statement signals: it will act in its national interest, not under external pressure.

Whether Trump’s claim is a bargaining chip, an exaggeration, or a peek behind closed-door assurances only time and data will tell.

Until then, the world watches closely as India’s energy path may steer the next shift in global geopolitics.

Abhi Platia is a financial analyst and geopolitical columnist who writes on global trade, central banks, and energy markets. At GeoEconomic Times, he focuses on making complex economic and geopolitical shifts clear and relevant for readers, with insights connecting global events to India, Asia, and emerging markets.