On 19 September 2025, Richard Moore, the outgoing head of Britain’s Secret Intelligence Service (MI6), delivered a blunt assessment in a public speech in Istanbul: there is “no evidence” that Russian President Vladimir Putin is interested in a negotiated peace with Ukraine that stops short of Ukrainian capitulation. The statement reported widely by outlets such as Reuters and The Guardian added an unmistakable note of urgency to a conflict many had hoped might ease amid diplomatic pushes and sanctions pressure.

This article goes deeper than the headlines. It unpacks Moore’s claim, places it alongside military analysis and data, and explores the political, humanitarian and strategic consequences if the MI6 chief is right and why policymakers, investors and ordinary citizens should care.

What Moore actually said and why it matters

Moore’s remarks were not casual. Speaking as he prepares to leave office, he framed the conflict as a geopolitical choice by Putin, not a bargaining error. As AP News summarized, Moore described a Russian leadership that has “bitten off more than it can chew,” that under-estimated Ukrainian resolve, and yet appears uninterested in a compromise that would preserve Ukraine’s sovereignty.

Why does a spy chief’s public judgment matter? Because intelligence assessments help shape the calculations of diplomats and defence planners. Moore’s words will be read in capitals from Kyiv to Washington, Warsaw to Beijing. If Britain’s foreign-intelligence service concludes that Putin seeks victory rather than compromise, allies may adjust resources, timelines and strategy accordingly.

The operational picture: Putin betting on attrition

Moore’s warning fits with what independent observers and open-source military analysts have been flagging for months. The Institute for the Study of War (ISW) has repeatedly documented Russian efforts to sustain long-term offensives and shore up a war-of-attrition strategy. A recent ISW assessment concluded that Russian command continues to act as if it can grind Ukraine down over time a posture consistent with statements that Russia has deployed hundreds of thousands of troops to the front. The ISW’s latest daily assessments underline that Moscow is trying to hold and push across multiple fronts rather than negotiate from weakness. (ISW assessment, Sept. 18, 2025)

That posture matters because wars of attrition are long, brutal and expensive. They reward a state willing to accept high logistics, personnel and materiel costs. It also means the battlefield will remain active: more strikes, more missile and drone attacks, slower but steady territorial contests and sustained humanitarian crises.

Hard data and signals

Several concrete datapoints help explain Moore’s conclusion and the likely trajectory ahead:

- Force levels: Russian official statements in recent days referred to very large force concentrations; independent observers estimate that the Kremlin has mobilized and rotated substantial manpower and equipment across multiple sectors of the front. (See ISW analysis above.)

- Industrial and economic resilience: Despite sanctions, Russia has maintained war production through retooling, domestic supply chain shifts and third-country procurement a fact analysts note when judging Moscow’s capacity for prolonged conflict. Reuters and other outlets have chronicled new sanction-busting routes and buyers. (Reuters on Russian sanction evasion reporting)

- Political messaging from Moscow: Russian leadership messaging increasingly frames the war as existential and historical language that reduces incentives to compromise. When a political narrative fuses domestic prestige with war aims, the room for negotiated settlement narrows.

Put bluntly: the raw inputs men, materiel, and message show a state preparing to persist rather than concede.

What this means for Ukraine and its partners

If Putin genuinely seeks to win through attrition, the implications are immediate and wide:

- Sustained military assistance for Kyiv. Western capitals will likely feel compelled to approve larger, more sustained deliveries of heavy weapons, ammunition, air defences and training. That is precisely the recommendation of many NATO-adjacent planners and think-tanks, who argue that only consistent, high-quality aid can offset attritional pressure. (See ISW and commentary from CSIS analysts.)

- Longer timelines and higher budgets. Defence planners must assume multiyear commitments not weeks. This influences national budgets, munitions production pipelines, and parliamentary approvals.

- Greater economic pain and humanitarian need. Ukraine’s reconstruction needs and refugee flows would remain elevated, with profound implications for EU budgets, energy markets and food security.

- Escalation risk. Prolonged conflict raises incidents of spillover (airspace violations, cross-border splashes of drones and missiles) and raises the odds of miscalculation incidents that could draw NATO more directly into crisis management roles.

The counterargument: is Moscow bluffing or bargaining?

Not everyone views Russian posture as a sign of absolute intransigence. Some diplomats and analysts suggest Moscow uses maximal battlefield rhetoric as a bargaining posture: hard lines today to extract security guarantees tomorrow. In negotiations theory, public maximalism can be paired with private pragmatism. Yet Moore’s point that there’s no visible evidence of sincere settlement intentions cuts into that optimism. Even if back-channel talks proceed, a domestic political environment that rewards “no surrender” makes meaningful compromises politically costly for Putin.

Economic and geopolitical spillovers

The conflict’s persistence would ripple through markets and geopolitics:

- Energy markets. Europe’s energy calculus remains fragile. A long war sustains risk premia for natural gas and oil, complicating inflation and fiscal balances. The EU is already accelerating alternatives to Russian fuels moves that amplify medium-term economic realignments.

- Defence industrial demand. Western defence manufacturers are seeing surging order books. A drawn-out conflict keeps procurement timelines long and raises demand for ammo and artillery a boon for some industries, a strain on public budgets.

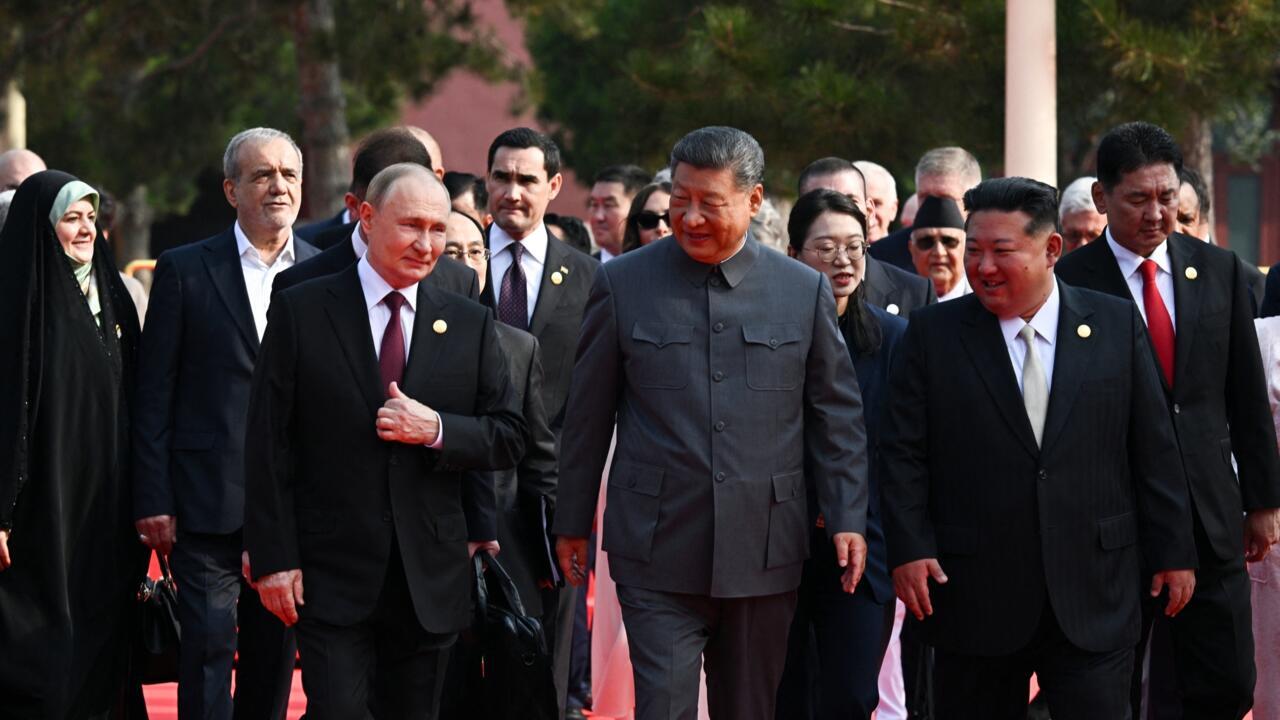

- Great power diplomacy. Beijing, Ankara, and New Delhi watch each shift closely. For China in particular, a long war forces calibration: deepening ties with Moscow while avoiding direct confrontation with the West a balancing act at the heart of 21st-century geopolitics.

Human stories behind the strategy

Beyond strategy and balance sheets lies human suffering. A long war means protracted displacement, disrupted harvests, and generations of lost education. Humanitarian agencies warn that sustained conflict will continue to fracture Ukrainian towns into protracted aid zones. That’s not an abstract risk: satellite imagery and NGO reports show towns where civilian infrastructure has been repeatedly struck, culminating in long cycles of rebuilding and destruction.

Policymakers often discuss “force levels” and “aid pipelines” as abstractions; Moore’s remark is a reminder that each analytic choice has a human ledger families uprooted, towns shelled, schools shuttered.

What would a credible peace pathway look like?

If “no evidence” of sincere peace exists today, what would change that? Several technical conditions could create room for negotiation:

- A credible security architecture for Ukraine, backed by international guarantees and phased demilitarization timelines.

- A staggered ceasefire tied to verifiable steps (withdrawals, prisoner exchanges, demining) coupled with third-party monitors.

- Economic and reconstruction packages huge enough to entice wartime economies to reorient something only major powers can credibly offer.

But crucially, the political incentives in Moscow must shift: either with a change in leadership calculations, a credible domestic shock that reorders priorities, or a diplomatic deal that preserves essential Kremlin narratives while removing the military rationale for escalation. Moore’s assessment implies none of those conditions look likely in the immediate term.

How allies and markets should react (practical takeaways)

- Plan for endurance. Governments should fund longer trains of military and humanitarian aid rather than episodic bursts. This includes ramping munitions production lines and pre-positioning logistics.

- Strengthen deterrence and resilience. NATO and partners must continue to reinforce eastern flank readiness to deter spillover and assure allies.

- Prepare economic buffers. Energy diversification, grain supply corridors and refugee-support budgets should be stress-tested for multi-year scenarios.

- Keep diplomatic channels open. Even if current signals are bleak, preserving communication channels reduces miscalculation risk.

Final assessment: Moore’s warning is a wake-up call

Richard Moore’s public declaration that he sees “no evidence” Putin wants to negotiate peace without Ukrainian capitulation is not merely rhetorical; it synthesizes intelligence, battlefield trends and political messaging into a stark conclusion. If Moore is right, the international community faces the uncomfortable reality of a protracted war that will demand sustained military, economic and humanitarian commitment.

If Moore is wrong, and there is a clandestine path to meaningful compromise, the world should still welcome a resolution. But prudence argues against gambling upon goodwill that has not yet materialized. In the meantime, allies must plan for endurance militarily, economically and morally to support Ukraine and to manage the global ripples of a conflict that refuses to end.

Abhi Platia is a financial analyst and geopolitical columnist who writes on global trade, central banks, and energy markets. At GeoEconomic Times, he focuses on making complex economic and geopolitical shifts clear and relevant for readers, with insights connecting global events to India, Asia, and emerging markets.