The Reserve Bank of India’s (RBI) 2025 Monetary Policy Meeting was no ordinary event. For the first time, the central bank was steered by Governor Sanjay Malhotra, whose appointment earlier this year symbolized a generational change in leadership. Markets, policymakers, and citizens alike were watching closely not just for the headline interest rate decision, but for hints about how Malhotra would position India’s monetary policy in a world marked by economic fragmentation, supply chain realignments, and persistent geopolitical shocks.

Unlike past policy meetings, where technical jargon dominated, Malhotra’s tone was refreshingly direct. He admitted the challenges upfront “India cannot remain insulated from global turbulence” while laying out a vision of flexibility and resilience. This approach already sets him apart from predecessors who often prioritized inflation control above all else.

Key Highlights of the 2025 Policy Meeting

1. Repo Rate on Hold, but Liquidity Gets a New Tool

The RBI kept the repo rate at 6.75%, maintaining stability after several hikes in 2023 and 2024. But the innovation was the introduction of a “forward-looking liquidity corridor.”

Instead of waiting for quarterly reviews, RBI will now adjust liquidity injections in real time, using predictive analytics tied to global commodity prices and capital flows. This essentially modernizes India’s monetary operations, bringing them closer to the agile frameworks seen in advanced economies.

For borrowers, this means EMI burdens won’t worsen immediately, though banks will face tighter scrutiny on lending practices. For businesses, it signals more stability, as they can plan investments without fearing sudden liquidity shocks.

2. Inflation Targeting Gets More Flexible

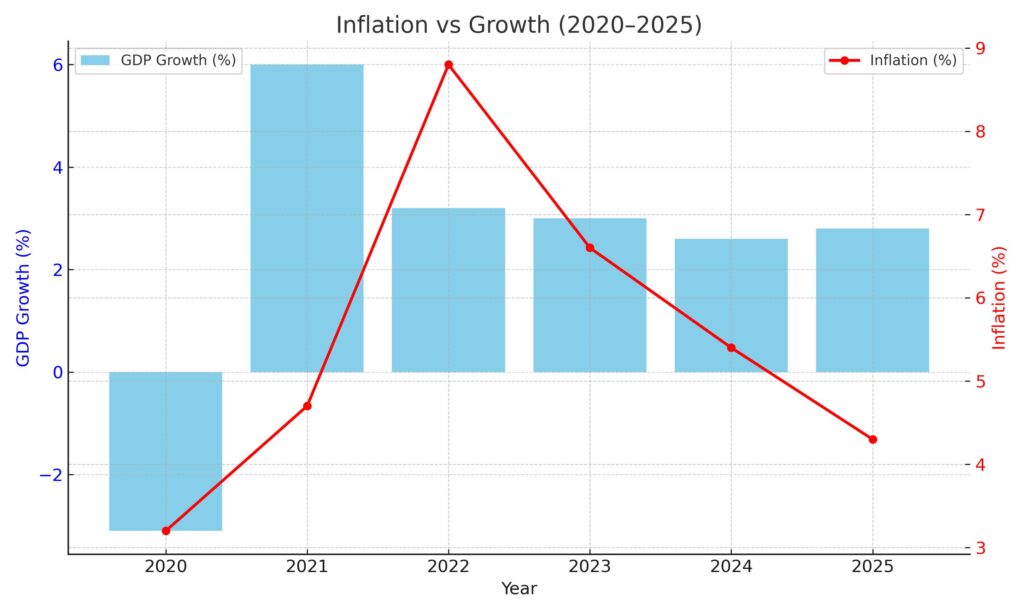

For years, RBI has stuck to a 4% inflation target, with an acceptable band of 2–6%. But Governor Malhotra admitted that “structural realities” make sub-4% inflation unrealistic in 2025.

Key drivers include:

- Imported food inflation due to climate-related crop failures abroad.

- Fuel price volatility linked to Gulf tensions and OPEC+ supply restrictions.

- Sticky service costs driven by rising wages in urban India.

Instead of pursuing a rigid goal, RBI will now tolerate sustained inflation in the 4–6% band, prioritizing growth and stability. This is a pragmatic pivot that acknowledges India’s unique position as a high-growth, high-demand emerging economy.

3. Digital Rupee Moves Beyond Pilot Stage

Perhaps the most forward-looking announcement was the decision to expand the digital rupee (e-₹) into cross-border transactions. Trials will begin with the UAE, Singapore, and Sri Lanka, focusing on trade settlements and remittances.

This marks a subtle but significant challenge to the dollar-dominated system. If successful, Indian workers abroad could remit funds directly in digital rupees, cutting costs and bypassing dependence on U.S. banking channels. Energy imports, too, could be settled in rupees reducing foreign exchange risks during oil shocks.

4. Banking Sector Discipline

RBI flagged concerns over excessive consumer lending. Credit card and personal loan growth has surged by nearly 24% YoY, raising alarms about household debt bubbles.

Malhotra cautioned banks that “irrational exuberance” in unsecured lending would be closely monitored. At the same time, the RBI incentivized lending towards MSMEs, renewable energy projects, and affordable housing areas aligned with India’s long-term growth priorities.

Analysis: Reading Between the Lines

A Hybrid Strategy

Governor Malhotra’s approach blends lessons from the past:

- From 2008, when tight policy shielded India from the worst of the global financial crisis.

- From 2020, when ultra-loose liquidity during COVID helped growth but fueled later inflation.

The 2025 stance is neither overly hawkish nor overly accommodative. It is, instead, a hybrid strategy: flexible on inflation, innovative on liquidity, and strategic on digital finance.

Risks and Opportunities Ahead

- Oil Price Volatility – If Brent crude rises above $100/barrel, inflation could breach the 6% tolerance, testing RBI’s credibility.

- Global Fed Divergence – With the U.S. Fed still hawkish, India’s softer stance could trigger short-term capital outflows.

- Digital Rupee Diplomacy – If early cross-border pilots succeed, India could emerge as a regional monetary innovator, strengthening ties with Gulf and Asian partners.

- Debt Bubbles – Overheating in consumer credit markets remains a domestic risk if banks do not self-correct.

Global and Regional Impact

Middle East

India’s rupee settlement plan could reshape energy trade with Gulf nations. If even a fraction of oil imports are denominated in rupees, India reduces its dollar exposure a critical step at a time of frequent U.S. sanctions and dollar weaponization.

China

While China grapples with deflation and slowing growth, India’s steady 6%+ growth backed by pragmatic monetary policy positions it as a more attractive investment destination. The divergence could deepen Asia’s internal economic rivalry.

United States

Investors will compare India’s tolerance of higher inflation against the Fed’s hawkish discipline. This divergence may cause short-term volatility in currency markets, but it also highlights India’s confidence in its domestic demand-driven economy.

Historical Perspective: RBI’s Evolution

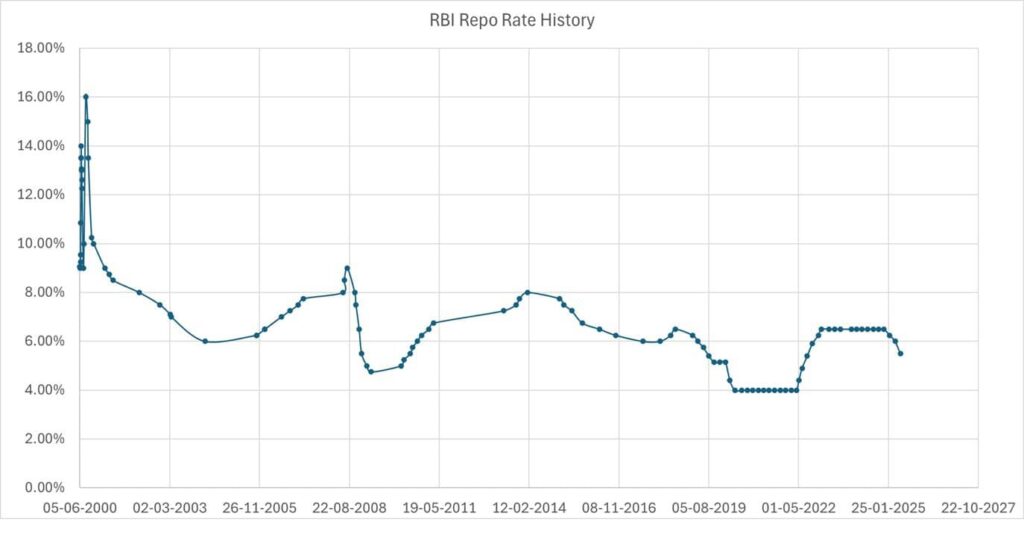

Timeline of Monetary Shifts (2008–2025):

- 2008: RBI tightened policy despite global crisis → protected rupee from capital flight.

- 2013: Taper Tantrum → emergency liquidity measures to stabilize markets.

- 2020: COVID crisis → unprecedented liquidity injections at growth’s expense.

- 2023–24: Inflation spike → aggressive repo hikes to 6.75%.

- 2025: Hybrid model → balancing inflation tolerance with growth and digital innovation.

This evolution shows how RBI has adapted from a defensive to a proactive central bank, now willing to experiment with new tools like predictive liquidity corridors and central bank digital currency (CBDC).

Impact on Ordinary Indians

For the common citizen, the policy decisions translate into real, everyday consequences:

- Borrowers: EMIs remain high but stable no immediate relief, but no fresh hikes either.

- Savers: Deposit rates stay attractive, encouraging financial savings over gold or real estate.

- Workers Abroad: If the digital rupee spreads, remittance costs could drop significantly.

- Consumers: Food and fuel remain the biggest pain points, but government subsidies may cushion the blow.

My Perspective: A Calculated Gamble

Governor Sanjay Malhotra has chosen a pragmatic, growth-first gamble. By openly accepting higher inflation tolerance, he risks criticism from purists but gains flexibility to protect India from external shocks.

The digital rupee push is not just a financial experiment it is a geopolitical statement. In a world where the dollar is increasingly weaponized, India is preparing alternatives, even if small in scale at first.

The risk lies in credibility. If inflation spikes above 6% or consumer debt defaults rise, critics will accuse the RBI of abandoning discipline. But if managed carefully, this hybrid policy could mark a new era where India leads not by copying Western central banks, but by crafting its own unique monetary path.

Abhi Platia is a financial analyst and geopolitical columnist who writes on global trade, central banks, and energy markets. At GeoEconomic Times, he focuses on making complex economic and geopolitical shifts clear and relevant for readers, with insights connecting global events to India, Asia, and emerging markets.