Moscow: Russian President Vladimir Putin’s latest remarks at the Valdai Discussion Club in Sochi sent ripples through global diplomatic circles. His powerful statement “India will never allow humiliation” was more than just praise for Prime Minister Narendra Modi. It was a symbolic reaffirmation of India’s strategic autonomy amid renewed U.S. pressure, escalating tariffs, and a shifting world order.

At a time when Washington is tightening economic screws on partners trading with Moscow, Putin’s endorsement of Modi’s leadership carries significant geopolitical weight. It reflects Moscow’s acknowledgment of India’s tightrope diplomacy balancing ties with Russia, the U.S., and an increasingly assertive China.

The Context: U.S. Tariffs and a Test of Indian Sovereignty

The backdrop to Putin’s praise is Washington’s imposition of an additional 25% tariff on Indian exports, raising the total tax to 50%. The move came after U.S. President Donald Trump’s fiery address at the United Nations General Assembly, where he accused both India and China of “funding Russia’s war in Ukraine” through continued oil purchases.

For New Delhi, these tariffs are not just economic irritants they are a sovereignty test. India has repeatedly stated that its energy imports are driven by economic logic, not political allegiance. Buying Russian crude at discounted prices has saved India nearly $9–10 billion in the past year, helping curb inflation and stabilize the rupee.

As Putin put it bluntly:

“If India refuses our energy supplies, it will suffer certain losses. If it doesn’t refuse, sanctions will follow. So why refuse if it also carries domestic political costs?”

Data Insight: India’s Energy Balancing Act

| Metric | 2022 | 2023 | 2024 | % Change |

|---|---|---|---|---|

| Share of Russian oil in India’s total imports | 2% | 14% | 32% | +1400% |

| Total crude imported (million barrels/day) | 4.2 | 4.6 | 5.1 | +21% |

| Savings via discounted Russian crude | — | $6.8B | $9.4B | +38% |

| U.S. Tariff Rate on Indian Goods | 25% | 50% | — | — |

Source: Ministry of Commerce (India), IEA, IMF 2024 Reports

This surge in Russian oil imports highlights India’s pragmatic stance: economic resilience first, political lectures later.

Putin’s Message: Respect for India’s Strategic Independence

During his Valdai speech, Putin emphasized that India’s foreign policy is nationally oriented, not dictated by external pressure. He described Modi as “a balanced, wise, and nationally oriented leader” a phrase deliberately chosen to contrast India’s independent diplomacy with the West’s bloc mentality.

“We have never had any problems or interstate tensions with India. Never,” Putin said.

“We appreciate that India has not forgotten its friendship with Russia since the days of the Soviet Union.”

The Russian leader also hinted at rebalancing trade relations, suggesting that Moscow could increase imports of Indian pharmaceuticals and agricultural goods to offset the trade imbalance a move that could benefit India’s farmers and exporters.

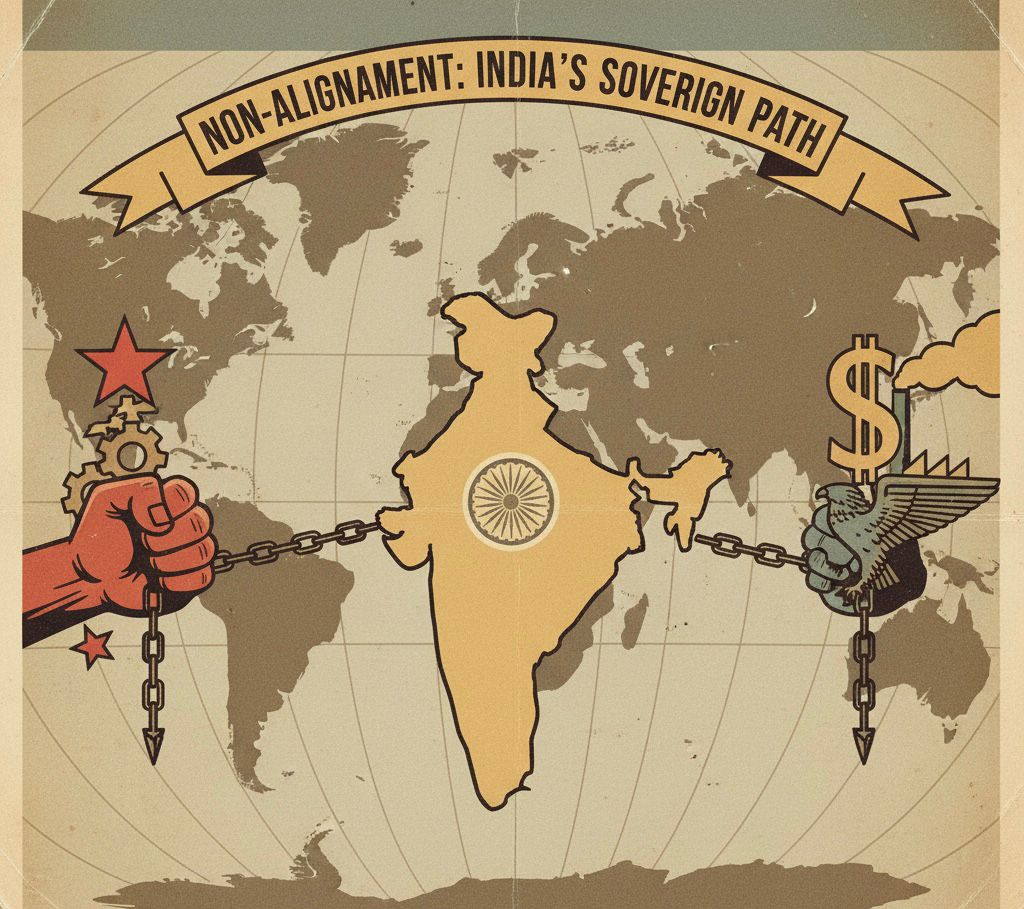

Historical Lens: Echoes of the Cold War Non-Alignment

Putin’s praise carries echoes of the Non-Aligned Movement (NAM) era, when India, under Jawaharlal Nehru, refused to align fully with either the U.S. or the USSR. Modi’s government, though far more assertive and market-oriented, is resurrecting that same strategic independence now branded as “multi-alignment.”

This modern iteration allows India to:

- Partner with the U.S. on defense and technology (via QUAD and iCET)

- Deepen energy and defense ties with Russia

- Expand trade with Gulf nations and Africa

- Maintain cautious engagement with China

This flexible diplomacy is the foundation of India’s geopolitical power in a fragmented world.

Expert Perspectives: What Analysts Say

Dr. Rakesh Sood, former Indian Ambassador to Russia, told Geoeconomic Times:

“Putin’s comments are both a compliment and a signal. Moscow wants to reassure New Delhi that despite its growing dependence on China, Russia values its historical friendship with India. At the same time, it’s warning Washington that India cannot be bullied.”

Elena Petrova, analyst at Moscow’s Institute of Strategic Studies, adds:

“The U.S. tariffs may backfire. They could push India and Russia to create a parallel payment system or strengthen BRICS economic cooperation something that aligns with Moscow’s long-term goal of de-dollarization.”

A senior official in India’s Ministry of External Affairs (as quoted by The Hindu) said,

“India will continue to make decisions based on its national interest. The U.S. tariffs may affect exports temporarily, but the strategic independence of India is not for sale.”

The Ripple Effects: Geoeconomics and Global Supply Chains

India’s oil deals with Russia have already altered Asia’s energy map. Russian crude now arrives at Indian ports like Jamnagar and Paradip before being refined and re-exported to Europe sometimes ironically, to the same countries that enforce sanctions on Russia.

This circular trade underlines the limits of Western economic pressure. According to Bloomberg data, nearly 40% of India’s Russian oil imports are re-exported as refined products, earning India billions and helping stabilize its current account.

Meanwhile, U.S. tariffs are expected to cost India around $4.5 billion annually in lost exports. Sectors like textiles, steel, and electronics are the hardest hit but India is already pivoting toward ASEAN, the Middle East, and Africa to diversify markets.

A Broader Geopolitical Angle: The India–US–Russia Triangle

The renewed friction underscores a deeper geopolitical realignment.

- Washington’s View: India must toe the Western line on sanctions.

- Moscow’s View: India’s independence is proof that the “Global South” is no longer submissive.

- New Delhi’s View: Strategic autonomy is not defiance it’s survival.

India’s balancing act is being closely watched in the Middle East, where similar pressures are building. Saudi Arabia and the UAE are also deepening energy and defense cooperation with Russia while maintaining close ties with the U.S. This multi-vector diplomacy is fast becoming the Global South’s defining feature.

Comparative Insight: When the U.S. Pressured Allies Before

This isn’t the first time the U.S. has tried to strong-arm its partners:

| Year | Country | Issue | Outcome |

|---|---|---|---|

| 1981 | Japan | Auto export quotas | Japan complied, but resentment fueled economic nationalism |

| 2018 | EU | Iran nuclear sanctions | EU created INSTEX to bypass U.S. sanctions |

| 2022 | Turkey | Russian S-400 missiles | U.S. suspended Ankara from F-35 program; Turkey deepened ties with Russia |

| 2025 | India | Russian crude trade | India refused to yield; Putin praised Modi’s resolve |

This pattern shows that Washington’s coercive diplomacy often leads to the opposite result pushing countries toward strategic self-reliance.

Future Scenarios: What Comes Next

- Tariff Retaliation: India could impose counter-tariffs or file a WTO complaint, citing discriminatory practices.

- Energy Diversification: Russia may offer deeper discounts, locking in long-term oil and LNG deals.

- New Payment Mechanisms: The rupee-ruble system or BRICS Pay could expand, bypassing the U.S. dollar.

- Political Optics: Modi’s image as a global statesman who “stands tall” against superpower pressure could bolster domestic support ahead of 2026 elections.

Opinion: A Defining Moment for India’s Global Identity

Putin’s statement might be seen as flattery, but it reflects an undeniable truth: India no longer plays second fiddle in global power politics.

By refusing to succumb to U.S. pressure and continuing its pragmatic engagement with Moscow, New Delhi is carving out a new model for developing nations one that prioritizes economic interest and dignity over alignment.

The U.S., in contrast, risks alienating one of its most crucial democratic partners in Asia. If Washington continues on its tariff path, it may discover that India’s friendship, much like its market, cannot be bought only respected.

Abhi Platia is a financial analyst and geopolitical columnist who writes on global trade, central banks, and energy markets. At GeoEconomic Times, he focuses on making complex economic and geopolitical shifts clear and relevant for readers, with insights connecting global events to India, Asia, and emerging markets.