In a move that has already caught the attention of global markets, Switzerland’s central bank has pivoted its foreign reserve preferences: the euro now tops dollar holdings, marking a subtle but powerful shift in reserve currency strategy. While the change may have flown under many radars, it carries ramifications not just for Switzerland, but for currency geopolitics, reserve management, and economies that depend heavily on the greenback.

Let’s unpack what’s happening, why it matters, and how it could ripple to places like India, the Gulf, and beyond.

What Just Happened: The Reserve Rebalancing

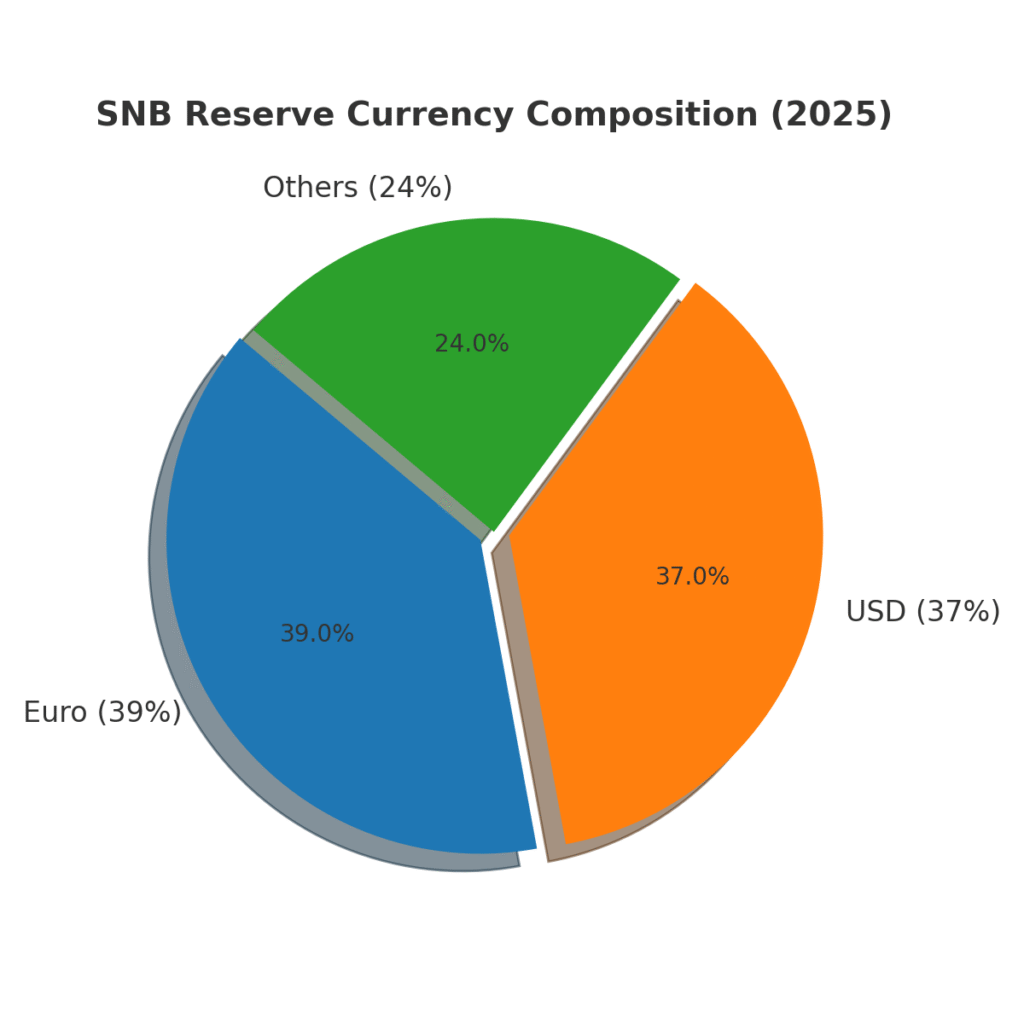

Recent data and reporting show the SNB has tilted its reserve currency mix:

- As of mid-2025, the euro held 39% of SNB’s foreign exchange reserves, edging past the dollar’s 37%.

- The SNB made over CHF 5.06 billion in foreign currency purchases in Q2, its highest quarterly intervention in over three years. That intervention was weighted heavily toward euro acquisitions.

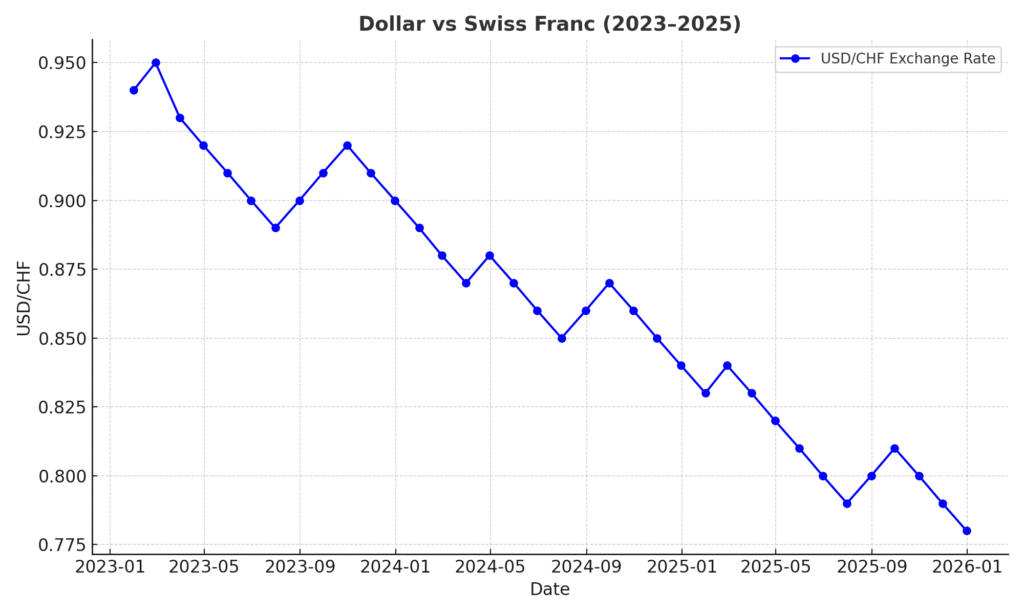

- One driver: the U.S. dollar has weakened. The SNB recorded a CHF 22.7 billion loss from its dollar holdings in H1 2025, due to roughly a 12% dollar depreciation versus the franc.

- The SNB and U.S. Treasury recently reaffirmed that they do not aim to manipulate exchange rates for trade advantage potentially giving Switzerland more breathing room for such FX moves.

In effect, Switzerland is quietly telling the world: its reserve strategy will rely less on the U.S. dollar and more on alternative reserve currencies especially the euro.

Why This Shift Is Significant

At first glance, 39% vs. 37% may sound marginal. But consider:

- Switzerland holds one of the largest central bank reserves in the world (exceeding CHF 700–800 billion). Even small reallocations move large volumes of capital.

- A pivot by such a major reserve manager signals to others: if Switzerland (with its reputation for prudence) is reallocating, others may follow.

- The SNB has publicly taken losses on dollar positions. That gives it a financial incentive to reduce dollar exposure.

- The political climate: U.S. tariffs and pressure on currency practices add a geopolitical overlay to what might otherwise be a technical decision.

This is more than portfolio rebalancing it is a signal that the “safe default” status of the dollar is being questioned by even the staunchest institutional holders.

Deeper Analysis: Why Switzerland, Why Now?

1. Dollar Weakness & Valuation Strain

A 12% slide in dollar vs. franc in H1 2025 eroded value of existing dollar-based reserve positions. That loss provides both cover and urgency for reallocation.

2. Diversification Imperative

For a central bank managing vast reserves, putting so many eggs in one dollar basket is risky. The euro already forms a significant share of Switzerland’s trade basket. The alignment makes economic sense.

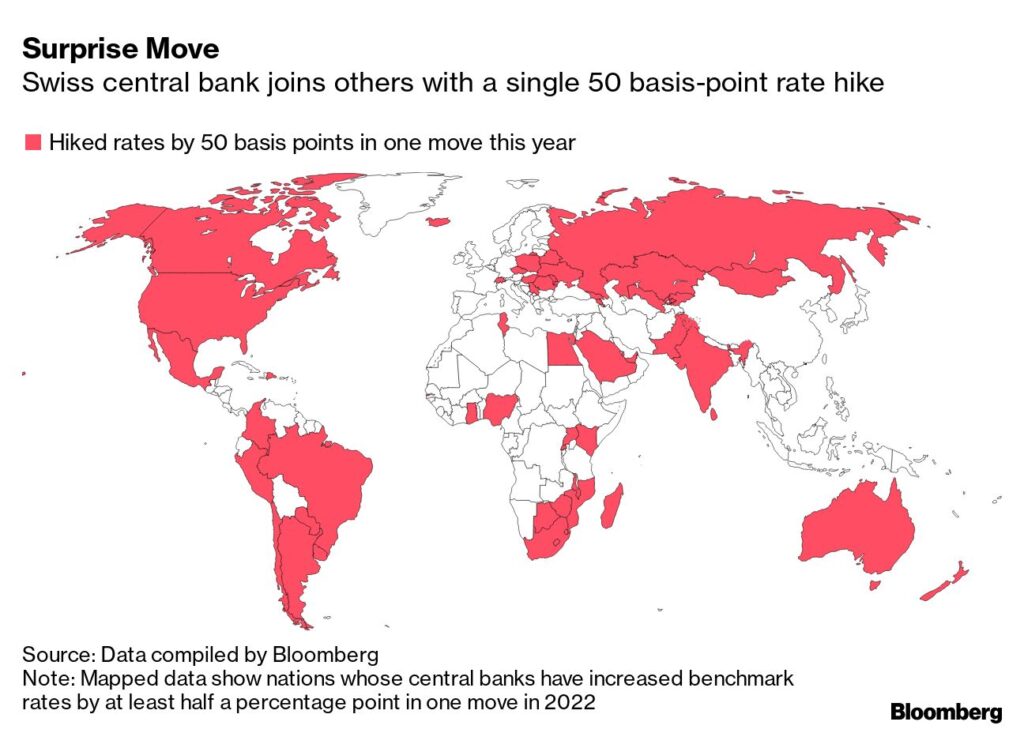

3. Political and Trade Tensions

The U.S. has recently imposed tariffs on Swiss exports and put Switzerland on currency watchlists. Switzerland may avoid dollar accumulation to reduce friction.

4. Strategic Signaling

By publicly shifting, SNB increases pressure on other central banks to reconsider their dollar denominated positions. It could be part of a broader, incremental transition away from dollar dominance.

Expert Voices & Interviews

- Olivier Korber, Societe Generale strategist, noted: “This sharp reallocation signals that SNB focused its efforts on preventing euro/franc depreciation.”

- Maxime Botteron, UBS economist, has observed that the SNB’s large losses in dollar holdings make such adjustments necessary to stabilize its balance sheet.

- In private, a gold markets analyst observed, “Switzerland’s move may embolden other neutral nations like Singapore or Hong Kong to quietly shift their reserve biases.”

These comments underscore that this is not a one-off markets expect follow-through.

Implications for India, Middle East & Beyond

For India

- India holds significant dollar reserves. A shift by SNB may prompt India’s Reserve Bank to reconsider its own reserve mix (perhaps leaning more on euro, yen, or other currencies).

- Rupee-dollar volatility may intensify, especially if capital flows react to other central banks’ moves.

- In trade and diplomatic terms, India may perceive Switzerland’s move as weakening dollar hegemony a development New Delhi may use to push for more multipolar financial architecture.

For Gulf / Middle East

- Gulf states are heavy dollar holders. A shift by SNB could accelerate strategic review in their own reserve policies.

- Many petro-contracts, sovereign funds, and financing deals are dollar-denominated; pressure to adopt dual currency strategies may grow.

- In regional geopolitics, leaning away from dollar dominance can strengthen sovereign autonomy vis-à-vis U.S. economic leverage.

Global Impact

This move adds momentum to the narrative: the dollar isn’t forever. The IMF’s data show that the dollar’s share in global FX reserves is slightly slipping. If Switzerland (a benchmark central banker) is rebalancing, it could accelerate broader systemic shifts.

Historical Comparisons & Lessons

- 1970s oil shock era: Many oil-exporting countries gradually diversified into USD, GBP, and other currencies to guard against dollars. The reverse may now be underway.

- 1990s and 2000s reserve diversification: Some emerging central banks diversified into euros, yen, and even into Asian currencies. That history shows transitions happen, but slowly.

- Post-2008 crisis: Central banks hoarded dollars as liquidity reserves; that structural bias reinforced dollar dominance. Now, structural shifts may be reversing.

Scenarios & What’s Next

| Scenario | Likelihood | Potential Outcome | Risks / Catalysts |

|---|---|---|---|

| Euro over Dollar becomes new norm | Moderate | Major central banks gradually reduce dollar holdings | U.S. responds aggressively, markets volatile |

| Selective diversification | High | Central banks diversify into euro, yen, yuan but retain some dollar exposure | Currency wars, geopolitical pushback |

| Reversal under pressure | Low–Moderate | If dollar rallies or U.S. pressure intensifies, SNB may partially revert | Policy misstep, market backlash |

| Multipolar reserve system | Low (long-term) | Reserves fragmented across currencies (dollar, euro, yuan, others) | Fragmentation risk, liquidity problems |

Which path unfolds depends on dollar trajectory, geopolitical tension, and trust in non-dollar systems.

Risks, Critiques & Counterarguments

- SNB still insists it does not “manipulate” for trade advantage its stated motive is monetary stability, not export advantage.

- Losing dollar exposure may reduce liquidity, because dollar markets remain deepest globally.

- If dollar rebounds sharply, SNB’s euro holdings could lose value; timing matters.

- Political backlash in U.S. accusations of undermining dollar hegemony could escalate pressure on Switzerland.

Conclusion: A Quiet Shift, a Loud Signal

Switzerland’s decision to tilt reserves from dollar toward euro isn’t loud, but it is potent. It signals that even the hardiest guardians of monetary stability see the need to rebalance away from the greenback.

For India and Gulf economies, the move may inspire reserve diversification, exchange rate rethinking, and shifts in financial strategy. Globally, it nudges the world further toward a multi-currency reserve paradigm.

Dollar dominance isn’t dead yet but it’s no longer unchallenged.

Abhi Platia is a financial analyst and geopolitical columnist who writes on global trade, central banks, and energy markets. At GeoEconomic Times, he focuses on making complex economic and geopolitical shifts clear and relevant for readers, with insights connecting global events to India, Asia, and emerging markets.